Contura Announces Second Quarter 2020 Results

• Reports net loss from continuing operations of $238 million for the second quarter 2020, including a pre-tax, non-cash asset impairment charge of $162 million

• Posts Adjusted EBITDA(1) of $17 million for the second quarter 2020

• Maintains strong cost management in all operating segments and overhead

• Executes on long-term strategic portfolio optimization

• Reduces long-term debt by approximately $25 million in the second quarter of 2020

• Continues conservative financial management with liquidity of $240 million at quarter-end and $66 million in AMT refunds expected to be received in second half of 2020

BRISTOL, Tenn., August 7, 2020 – Contura Energy, Inc. (NYSE: CTRA), a leading U.S. coal supplier, today reported results for the second quarter ending June 30, 2020.

(millions, except per share)

Three months ended June 30, 2020 Three months ended Mar. 31, 2020 Three months ended June 30, 2019(2)

Net (loss) income(3) $(238.3) $(39.8) $24.3

Net (loss) income(3) per diluted share $(13.02) $(2.18) $1.25

Adjusted EBITDA(1) $16.9 $60.2 $140.8

Operating cash flow(4) $79.0 $(0.1) $102.5

Capital expenditures $(41.5) $(49.6) $(42.8)

Tons of coal sold 5.1 5.5 6.4

1. These are non-GAAP financial measures. A reconciliation of Net Income to Adjusted EBITDA is included in tables accompanying the financial schedules.

2. Excludes discontinued operations, except as noted.

3. From continuing operations. First and second quarters 2020 no longer have discontinued operations.

4. Includes discontinued operations. First and second quarters 2020 no longer have discontinued operations.

“Our second quarter results serve as continued evidence of Contura’s commitment to adeptly managing through the current global uncertainty,” said chairman and chief executive officer, David Stetson. “Even with a weeks-long furlough in April, our team increased our cash quarter-over-quarter, lowered our overall debt, and kept costs roughly on par with our stellar first quarter cost performance. As we look to the back half of 2020, we believe these steps to streamline our company will serve us well despite any additional market fluctuations that may occur.”

Financial Performance

Contura reported a net loss from continuing operations of $238.3 million, or $13.02 per diluted share, for the second quarter 2020. The second quarter loss includes a pre-tax, non-cash asset impairment charge of $161.7 million, which resulted primarily from our strategic decisions to idle the Kielty mine and not pursue the new impoundment at Cumberland resulting in a significantly shorter mine life. In the first quarter 2020, the company had a net loss from continuing operations, including non-cash asset impairment charges of $33.7 million, of $39.8 million or $2.18 diluted share.

Total Adjusted EBITDA was $17 million for the second quarter, compared with $60 million in the first quarter, primarily due to lower CAPP – Met price realizations.

Coal Revenues

(millions) Three months ended June 30, 2020 Three months ended Mar. 31, 2020

CAPP - Met $316.3 $362.4

CAPP - Thermal $36.7 $38.7

NAPP $57.5 $66.9

CAPP - Met (excl. f&h)(1) $261.5 $308.7

CAPP - Thermal (excl. f&h)(1) $32.1 $35.0

NAPP - (excl. f&h)(1) $52.0 $64.6

Tons Sold (millions) Three months ended June 30, 2020 Three months ended Mar. 31, 2020

CAPP - Met 3.2 3.3

CAPP - Thermal 0.6 0.6

NAPP 1.3 1.5

1. Represents Non-GAAP coal revenues which is defined and reconciled under “Non-GAAP Financial Measures” and “Results of Operations.”

The CAPP – Met revenue decline in the second quarter was driven by an $11 per ton decline in price realizations relative to the first quarter. CAPP – Thermal revenues also declined quarter-over-quarter due to lower realized prices. Second quarter NAPP revenues were lower as a result of lower volumes and prices.

Coal Sales Realization(1)

(per ton) Three months ended June 30, 2020 Three months ended Mar. 31, 2020

CAPP - Met $81.61 $92.80

CAPP - Thermal $49.52 $56.73

NAPP $40.19 $42.81

1. Represents Non-GAAP coal sales realization which is defined and reconciled under “Non-GAAP Financial Measures” and “Results of Operations.”

The second quarter 2020 metallurgical coal prices continued softening, with our average CAPP – Met coal sales realization declining 12 percent to $81.61 per ton against the prior quarter. While our domestic business continues to benefit from annual fixed price contracts, the lower second quarter realizations were primarily driven by our export business, where prices declined as a result of COVID-19 related demand reduction. Thermal coal price realizations were also impacted by reduced demand in the second quarter with both CAPP – Thermal and NAPP segments experiencing lower realizations.

Cost of Coal Sales

(in millions, except per ton data) Three months ended June 30, 2020 Three months ended Mar. 31, 2020

Cost of Coal Sales $383.3 $397.9

Cost of Coal Sales (excl. f&h/idle)(1) $310.5 $328.1

(per ton) Three months ended June 30, 2020 Three months ended Mar. 31, 2020

CAPP - Met(1) $74.41 $70.68

CAPP - Thermal(1) $45.38 $53.07

NAPP(1) $32.98 $39.68

1. Represents Non-GAAP cost of coal sales per ton which is defined and reconciled under “Non-GAAP Financial Measures” and “Results of Operations.”

Contura achieved continued strong cost performance in its CAPP – Met segment in the second quarter. The reported second quarter cost of coal sales was $74.41 per ton versus $70.68 per ton in the first quarter. Excluding the impact of the April furloughs, incremental one-time COVID-19 mitigation costs, and the partially offsetting benefit from an annual severance tax adjustment, the second quarter cost of coal sales were roughly on par with first quarter.

NAPP cost of coal sales for the quarter was $32.98 per ton, down from $39.68 per ton in the first quarter, which was impacted by a longwall move in March. CAPP – Thermal also reported solid cost of coal sales performance, improving to $45.38 per ton for the quarter as compared to $53.07 for the prior quarter.

Selling, general and administrative (SG&A) and depreciation, depletion and amortization (DD&A) expenses

(millions) Three months ended June 30, 2020 Three months ended Mar. 31, 2020

SG&A $12.0 $15.5

Less: non-cash stock compensation and one-time expenses $(1.9) $(2.1)

Non-GAAP SG&A(1) $10.1 $13.4

DD&A $49.3 $54.5

1. Represents Non-GAAP SG&A which is defined under “Non-GAAP Financial Measures.”

As a result of additional overhead reductions, Contura’s second quarter 2020 SG&A expenses were $10.1 million, excluding non-cash stock compensation expense and one-time expenses of $1.9 million, and down $3.3 million from the prior quarter. Contura expects non-GAAP SG&A expenses for the full year 2020 to be in the range of $45 million to $50 million.

Liquidity and Capital Resources

“In response to the wide-ranging impacts of the COVID-19 pandemic, we took aggressive action in early April to optimize cash by temporarily idling certain operations, which resulted in a $41 million reduction in inventory and overall net working capital change of $99 million in the second quarter,” said Andy Eidson, Contura’s chief financial officer. “As we continue to analyze our liquidity, we expect capex for the remainder of the year to be in the $45-$50 million range, and we still anticipate receiving an accelerated AMT tax refund of approximately $66 million in the second half of the year and approximately $14 million of payroll tax deferrals until 2021 and 2022.”

Cash provided by operating activities for the second quarter 2020 was $79.0 million and capital expenditures for the second quarter were $41.5 million. In the prior period, the cash used in operating activities was $0.1 million and capital expenditures were $49.6 million. Contura expects capital expenditures for the full year 2020 to be in the range of $135 million to $140 million.

As of June 30, 2020, Contura had $238.4 million in unrestricted cash and $157.5 million in restricted cash, deposits and investments. Total long-term debt, including the current portion of long-term debt as of June 30, 2020, was $628.1 million, down approximately $25 million from the prior quarter. At the end of the second quarter, the company had total liquidity of $240.2 million, including cash and cash equivalents of $238.4 million and $1.8 million of unused commitments available under the Asset-Based Revolving Credit Facility. The future available capacity under the Asset-Based Revolving Credit Facility is subject to inventory and accounts receivable collateral requirements and the achievement of certain financial ratios. As of June 30, 2020, the company had $30.8 million in borrowings and $121.7 million in letters of credit outstanding under the Asset-Based Revolving Credit Facility.

Operational and Strategic Update

As previously announced, certain operations were temporarily idled in early April in response to market conditions, inventory levels and expected customer deferrals. As of May 4, all Contura sites were back to nearly normal staffing levels and operating capacity with additional precautions in place to help reduce the risk of exposure to COVID-19.

On May 29, two previously wholly-owned subsidiaries of Contura Energy—Contura Coal West, LLC and Contura Wyoming Land, LLC—merged with certain subsidiaries of Eagle Specialty Materials, LLC. In completing this transaction, Contura ended its connection with the Powder River Basin.

On June 22, the company announced that its Ruby Energy (also known as Kielty) underground mine and the Delbarton Preparation Plant were to be idled due to adverse market conditions and uneconomic pricing and cost structures. Kielty produces both thermal and metallurgical coal.

During the second quarter, the company also decided against spending over $60 million for a refuse impoundment at Cumberland Mine and amended its supply agreements to expire as of December 31, 2022. Unless a buyer emerges for the Cumberland Mine, the company will cease operations upon the expiration of its outstanding coal supply commitments in late 2022 or early 2023.

Also in June, the company completed the acquisition of the Feats Loadout facility in Logan County, West Virginia, which is served by the CSX railroad. With this transaction, Contura adds transportation optionality to its existing network and increased ability to leverage low vol metallurgical coal sales opportunities through Dominion Terminal Associates.

Looking ahead, the company continues to progress on its capital projects and its shift to higher-quality, lower-cost mines. “Even in spite of the disruptions caused by the COVID-19 pandemic, development at our new metallurgical mines remains on schedule,” said Jason Whitehead, Contura’s chief operating officer. “The low vol Road Fork No. 52 Mine added a second production section in mid-June, and will be positioned to be at three sections by the first of 2021, while the high vol project at Lynn Branch has completed initial underground cuts and expects to be in production by the fourth quarter of this year. The Black Eagle Mine, our high vol A project, is progressing well through the corridor to the main reserve block, which we anticipate to be in production by next year.”

Conference Call

The company plans to hold a conference call regarding its second quarter 2020 results on August 7, 2020, at 10:00 a.m. Eastern time. The conference call will be available live on the investor section of the company’s website at https://investors.conturaenergy.com/investors. Analysts who would like to participate in the conference call should dial 866-270-1533 (domestic toll-free) or 412-317-0797 (international) approximately 15 minutes prior to the start of the call.

ABOUT CONTURA ENERGY

Contura Energy (NYSE: CTRA) is a Tennessee-based coal supplier with affiliate mining operations across major coal basins in Pennsylvania, Virginia and West Virginia. With customers across the globe, high-quality reserves and significant port capacity, Contura Energy reliably supplies both metallurgical coal to produce steel and thermal coal to generate power. For more information, visit www.conturaenergy.com.

FORWARD-LOOKING STATEMENTS

This news release includes forward-looking statements. These forward-looking statements are based on Contura’s expectations and beliefs concerning future events and involve risks and uncertainties that may cause actual results to differ materially from current expectations. These factors are difficult to predict accurately and may be beyond Contura’s control. Forward-looking statements in this news release or elsewhere speak only as of the date made. New uncertainties and risks arise from time to time, and it is impossible for Contura to predict these events or how they may affect Contura. Except as required by law, Contura has no duty to, and does not intend to, update or revise the forward-looking statements in this news release or elsewhere after the date this release is issued. In light of these risks and uncertainties, investors should keep in mind that results, events or developments discussed in any forward-looking statement made in this news release may not occur.

FINANCIAL TABLES FOLLOW

Non-GAAP Financial Measures

The discussion below contains “non-GAAP financial measures.” These are financial measures which either exclude or include amounts that are not excluded or included in the most directly comparable measures calculated and presented in accordance with generally accepted accounting principles in the United States (“U.S. GAAP” or “GAAP”). Specifically, we make use of the non-GAAP financial measures “Adjusted EBITDA,” “non-GAAP coal revenues,” “non-GAAP cost of coal sales,” and “Adjusted cost of produced coal sold.” We use Adjusted EBITDA to measure the operating performance of our segments and allocate resources to the segments. Adjusted EBITDA does not purport to be an alternative to net income (loss) as a measure of operating performance. We use non-GAAP coal revenues to present coal revenues generated, excluding freight and handling fulfillment revenues. Non-GAAP coal sales realization per ton for our operations is calculated as non-GAAP coal revenues divided by tons sold. We use non-GAAP cost of coal sales to adjust cost of coal sales to remove freight and handling costs, depreciation, depletion and amortization – production (excluding the depreciation, depletion and amortization related to selling, general and administrative functions), accretion on asset retirement obligations, amortization of acquired intangibles, net, idled and closed mine costs and coal inventory acquisition accounting impacts. Non-GAAP cost of coal sales per ton for our operations is calculated as non-GAAP cost of coal sales divided by tons sold. Non-GAAP coal margin per ton for our coal operations is calculated as non-GAAP coal sales realization per ton for our coal operations less non-GAAP cost of coal sales per ton for our coal operations. We also use Adjusted cost of produced coal sold to distinguish the cost of captive produced coal from the effects of purchased coal. The presentation of these measures should not be considered in isolation, or as a substitute for analysis of our results as reported under GAAP.

Management uses non-GAAP financial measures to supplement GAAP results to provide a more complete understanding of the factors and trends affecting the business than GAAP results alone. The definition of these non-GAAP measures may be changed periodically by management to adjust for significant items important to an understanding of operating trends and to adjust for items that may not reflect the trend of future results by excluding transactions that are not indicative of our core operating performance. Furthermore, analogous measures are used by industry analysts to evaluate the Company’s operating performance. Because not all companies use identical calculations, the presentations of these measures may not be comparable to other similarly titled measures of other companies and can differ significantly from company to company depending on long-term strategic decisions regarding capital structure, the tax jurisdictions in which companies operate, and capital investments.

Included below are reconciliations of non-GAAP financial measures to GAAP financial measures.

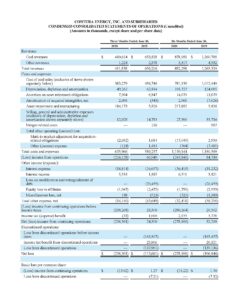

CONTURA ENERGY, INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited)

(Amounts in thousands, except share and per share data)

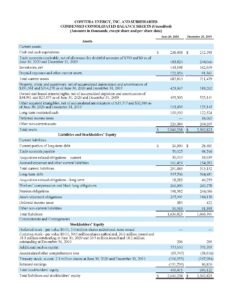

CONTURA ENERGY, INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED BALANCE SHEETS (Unaudited)

(Amounts in thousands, except share and per share data)

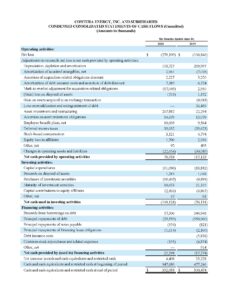

CONTURA ENERGY, INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited)

(Amounts in thousands)

CONTURA ENERGY, INC. AND SUBSIDIARIES ADJUSTED EBITDA RECONCILIATION

(Amounts in thousands)

CONTURA ENERGY, INC. AND SUBSIDIARIES RESULTS OF OPERATIONS

(Amounts in thousands, except for per ton data)