Contura Announces Fourth Quarter and Full-Year 2018 Results

BRISTOL, Tenn., April 1, 2019 – Contura Energy, Inc. (NYSE: CTRA), a leading U.S. coal supplier, today reported results for the fourth quarter and full-year 2018 through December 31, 2018.

Highlights include:

- Net income from continuing operations of $156 million for the fourth quarter 2018 compared with net income of $115 million in the same period last year[1]

- Adjusted EBITDA of $111 million for the quarter compared with $44 million in the same period last year[1][2]

- Merger-related synergies progressing ahead of schedule

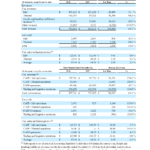

| Three months ended Dec. 31, 2018[1] | Three months ended Dec. 31, 2017[1] | Twelve months ended Dec. 31, 2018[1] | Twelve months ended Dec. 31, 2017[1] | |

|---|---|---|---|---|

| Net income[3] | $155.9 | $114.7 | $302.9 | $173.7 |

| Net income[3] per diluted share | $9.85 | $10.83 | $25.86 | $16.13 |

| Adjusted EBITDA[2] | $111.2 | $44.4 | $335.1 | $278.5 |

| Operating cash flow[4] | $(17.9) | $54.3 | $158.4 | $314.3 |

| Capital expenditures | $25.2 | $24.4 | $81.9 | $72.7 |

| Tons of coal sold | 5.5 | 3.4 | 17.6 | 15.7 |

1. Excludes discontinued operations, except as noted.

2. These are non-GAAP financial measures. A reconciliation of Net Income to Adjusted EBITDA is included in tables accompanying the financial schedules.

3. From continuing operations.

4. Includes discontinued operations.

“Between the successful completion of our merger with Alpha and the refinancing of our term loans, along with our listing on the New York Stock Exchange, the fourth quarter of 2018 was filled with significant strategic milestones for the future of our company,” said Kevin Crutchfield, chief executive officer. “Immediately after the closing of those transactions, our focus shifted towards integration and synergy realization – and we are making excellent progress on both fronts with synergies progressing ahead of our initial expectations. In addition to emphasizing operational enhancements, we continue to increase our investor outreach to expand our visibility as a recently-listed NYSE company.”

Financial Performance

The following fourth quarter results reflect a full quarter of Contura results and a partial quarter of Alpha results post-merger. Contura has four reportable segments: Central Appalachia (CAPP) – Met, CAPP – Thermal, Northern Appalachia (NAPP), and Trading and Logistics (T&L).

Total revenues in the fourth quarter were $572.1 million. Coal revenues in the fourth quarter, excluding freight and handling fulfillment revenues, were $479.2 million, with CAPP – Met coal revenues accounting for $247.2 million, T&L accounting for $106.4 million, and NAPP coal revenues totaling $89.9 million. CAPP – Thermal revenues were $35.7 million for a partial fourth quarter 2018. Comparatively, in the fourth quarter 2017, CAPP – Met revenues were $90.2 million, T&L revenues were $141.1 million, and NAPP revenues were $61.1 million of the $292.4 million in total coal revenues.

CAPP – Met coal shipments for the fourth quarter 2018 were 2.1 million tons at an average per-ton realization of $119.37, compared to 0.8 million tons at $109.09 per ton in the prior year’s fourth quarter. Contura shipped 2.0 million tons of NAPP coal during the quarter at an average per-ton realization of $45.63, up from 1.4 million tons at $43.89 per ton in the fourth quarter 2017. CAPP – Thermal shipments for a partial quarter were 0.6 million tons. In the T&L segment, coal volumes were 0.8 million tons in the fourth quarter of 2018, down from 1.2 million tons in the fourth quarter 2017. Fourth quarter 2018 included Alpha-related T&L sales only through the merger closing on November 9, after which they are accounted for as part of captive CAPP – Met sales. The average T&L realization increased from $115.37 per ton in the prior year’s fourth quarter to $127.88 per ton during fourth quarter 2018.

Freight and handling fulfillment revenues in the fourth quarter 2018 were $95.1 million compared with $56.0 million in the prior year period.

Total costs and expenses during the fourth quarter 2018 were $554.7 million and cost of coal sales was $366.7 million, compared with $304.9 million and $245.2 million, respectively, in the same period a year ago. The cost of coal sales in CAPP – Met for the quarter averaged $84.14 per ton, up from $74.68 in the prior year period. CAPP – Met costs include $0.49 per ton in idle costs. The main drivers of increased costs versus last year expectations were higher labor costs, which accounted for approximately $4.00 a ton of the increased costs, and higher supply and maintenance costs, which increased costs by approximately $3.50 per ton. Also, higher sales-related costs resulting from strong metallurgical coal realizations contributed to higher costs per ton by approximately $1.00. CAPP – Thermal cost of coal sales averaged $67.40 per ton in the fourth quarter 2018, including idle costs of $0.32 per ton, and were elevated due to accelerated reclamation at a surface mine.

NAPP cost of coal sales was $32.64 per ton compared with $46.04 per ton in the year-ago period, which was negatively impacted by a previously disclosed roof fall. In the T&L segment, the cost of coal sales during the fourth quarter 2018 was $101.68 per ton versus $97.62 per ton in the fourth quarter 2017.

Selling, general and administrative (SG&A) expenses for the fourth quarter 2018 were $15.8 million, up from $11.4 million in the year-ago period. The year-ago period included approximately $2.7 million in non-cash stock compensation and charges related to the company’s incentive plan. Included in the SG&A costs for the fourth quarter 2018 is approximately $3.1 million in non-cash stock compensation. Depreciation, depletion and amortization was $43.6 million during the fourth quarter 2018 and amortization of acquired intangibles was $(17.9) million, compared with $9.6 million and $9.9 million, respectively, in the same period last year, excluding discontinued operations.

Contura reported net income from continuing operations of $155.9 million, or $9.85 per diluted share from continuing operations, for the fourth quarter 2018. In the fourth quarter 2017, the company had net income from continuing operations of $114.7 million or $10.83 per diluted share from continuing operations.

Total adjusted EBITDA was $111.2 million for the fourth quarter, compared with $44.4 million in the fourth quarter of 2017, adjusted to remove the impact of discontinued operations.

Liquidity and Capital Resources

Cash used for operating activities for the fourth quarter 2018, including discontinued operations, was $17.9 million and capital expenditures for the fourth quarter were $25.2 million. In the prior year period, the cash provided by operating activities was $54.3 million and capital expenditures were $24.4 million. Capital expenditures of $2.3 million from discontinued operations are excluded from the prior year’s total.

At the end of December 2018, Contura had $233.6 million in unrestricted cash. Total long-term debt, including the current portion of long-term debt as of December 31, 2018, was approximately $588.0 million. At the end of the quarter, the company had total liquidity of $429.9 million, including cash and cash equivalents of $233.6 million and $196.3 million of unused commitments available under the Asset-Based Revolving Credit Facility. As of December 31, 2018, the company had no borrowings and $28.7 million in letters of credit outstanding under the Asset-Based Revolving Credit Facility. Additionally, as a result of the merger with Alpha, the Company assumed $135.7 million in letters of credit outstanding under the Amended and Restated Letter of Credit Agreement and $11.9 million in letters of credit outstanding under the Credit and Security Agreement.

Merger Update

On November 9, 2018, Contura’s merger with ANR, Inc. and Alpha Natural Resources Holdings, Inc. (together “Alpha”) was completed, creating the largest metallurgical coal supplier in the U.S., complemented by a cost-competitive thermal coal portfolio.

In conjunction with the transaction closing, Contura (“CTRA”) shares were listed and began trading on the New York Stock Exchange. Concurrently, the company refinanced its and legacy-Alpha’s term loans with a new $550 million, 7-year term loan credit facility. In addition, the company increased its asset-backed revolving credit facility from $125 million to $225 million.

The company is making solid strides on the integration front and the anticipated synergy realizations on a run-rate basis are progressing ahead of the company’s initial schedule, which targeted $30 million to $50 million in 2019.

Conference Call

The company plans to hold a conference call regarding its fourth quarter and full-year 2018 results on April 3, 2019, at 9:00 a.m. EST. The conference call will be available live on the investor section of the company’s website at http://investors.conturaenergy.com/investors. Analysts who would like to participate in the conference call should dial 877-791-0213 (domestic toll-free) or 647-689-5651 (international) approximately 10 minutes prior to the start of the call.

ABOUT CONTURA ENERGY

Contura Energy (NYSE: CTRA) is a Tennessee-based coal supplier with affiliate mining operations across major coal basins in Pennsylvania, Virginia and West Virginia. With customers across the globe, high-quality reserves and significant port capacity, Contura Energy reliably supplies both metallurgical coal to produce steel and thermal coal to generate power. For more information, visit www.conturaenergy.com.

FORWARD-LOOKING STATEMENTS

This news release includes forward-looking statements. These forward-looking statements are based on Contura’s expectations and beliefs concerning future events and involve risks and uncertainties that may cause actual results to differ materially from current expectations. These factors are difficult to predict accurately and may be beyond Contura’s control. Forward-looking statements in this news release or elsewhere speak only as of the date made. New uncertainties and risks arise from time to time, and it is impossible for Contura to predict these events or how they may affect Contura. Except as required by law, Contura has no duty to, and does not intend to, update or revise the forward-looking statements in this news release or elsewhere after the date this release is issued. In light of these risks and uncertainties, investors should keep in mind that results, events or developments discussed in any forward-looking statement made in this news release may not occur.

FINANCIAL TABLES FOLLOW

Use of Non-GAAP Measures

In addition to the results prepared in accordance with generally accepted accounting principles in the United States (GAAP) provided throughout this press release, Contura has presented the following non-GAAP financial measures: “Adjusted EBITDA” and “Adjusted Cost of Produced Coal Sold.” The company uses Adjusted EBITDA to measure the operating performance of its segments and allocate resources to the segments. This non-GAAP financial measure excludes various items detailed in the attached reconciliation tables. Adjusted EBITDA does not purport to be an alternative to net income (loss) as a measure of operating performance. The Company uses Adjusted Cost of Produced Coal Sold to distinguish the cost of captive produced coal from the effects of purchased coal, idle costs and acquisition accounting requirements. The presentation of these measures should not be considered in isolation, or as a substitute for analysis of our results as reported under GAAP.

Management uses non-GAAP financial measures to supplement GAAP results to provide a more complete understanding of the factors and trends affecting the business than GAAP results alone. The definition of these non-GAAP measures may be changed periodically by management to adjust for significant items important to an understanding of operating trends. Because not all companies use identical calculations, the presentations of these measures may not be comparable to other similarly titled measures of other companies and can differ significantly from company to company depending on long-term strategic decisions regarding capital structure, the tax jurisdictions in which companies operate, and capital investments.

Included below are reconciliations of non-GAAP financial measures to GAAP financial measures.

CONTURA ENERGY, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(Amounts in thousands, except share and per share data)

CONTURA ENERGY, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(Amounts in thousands, except share and per share data)

CONTURA ENERGY, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Amounts in thousands)

CONTURA ENERGY, INC. AND SUBSIDIARIES

ADJUSTED EBITDA RECONCILIATION

(Amounts in thousands)

CONTURA ENERGY, INC. AND SUBSIDIARIES

RESULTS OF OPERATIONS