Contura Announces Fourth Quarter and Full-Year 2017 Results

BRISTOL, Tenn., March 29, 2018 – Contura Energy, Inc., a leading U.S. coal supplier, today reported results for the fourth quarter and full year through December 31, 2017.

Highlights include:

- Net Income of $97 million for the fourth quarter and $155 million for the full-year 2017

- Adjusted EBITDA from continuing and discontinued operations of $45 million for the fourth quarter and $300 million for the full-year 2017[1]

- Repurchased 530,000 shares for $31.8 million in December and a total of 839,310 shares for $49.2 million over the course of the year

- Paid $100.7 million in special dividends in 2017

- Divested Powder River Basin assets for deferred consideration of up to $50 million; transaction reduces the company’s reclamation obligations by approximately $120 million

(millions, except per share)

| Fourth Quarter 2017[1] | Full-Year 2017[1] | |

|---|---|---|

| Coal revenues [2] | $292.4 | $1,392.5 |

| Net Income | $96.6 | $154.5 |

| Net Income per diluted share | $9.13 | $14.35 |

| Adjusted EBITDA [3][4] | $44.7 | $300.2 |

| Operating cash flow | $59.7 | $305.6 |

| Capital expenditures | $26.7 | $83.1 |

| Tons of coal sold[2] | 3.4 | 15.7 |

[1] Includes continuing operations and discontinued operations resulting from the divestiture of PRB unless otherwise noted.

[2] Excludes discontinued operations.

[3] These are non-GAAP financial measures. A reconciliation of net loss to adjusted EBITDA is included in tables accompanying the financial schedules. Contura’s Adjusted EBITDA calculation adds back accretion expense, a non-cash expense.

[4] Includes $8.6 million and $41.9 million, respectively for fourth quarter and full year, from discontinued operations.

“Contura’s first full year of operation was a very busy and successful one,” said Kevin Crutchfield, chief executive officer. “We took a number of strides toward strengthening the company’s balance sheet, grew our Trading and Logistics capabilities, and actively pursued a number of accretive shareholder actions. Specifically, we refinanced our Senior Secured First Lien Notes at much more attractive terms. We increased our stake in the strategically important DTA terminal to 65%. We returned $150 million to shareholders through a special dividend and share buybacks. And we divested our assets in the Powder River Basin to sharpen our focus on the company’s higher margin operations. I have every expectation that 2018 will be another safe and productive year for the company as we continue to consider additional strategic actions for the benefit of our shareholders and employees.”

Financial Performance

Unless otherwise stated, the following discussion excludes the discontinued operations from the sale of Powder River Basin (PRB).

Coal revenues in the fourth quarter were $292.4 million, with Central Appalachia (CAPP) metallurgical coal revenues accounting for $90.2 million and Trading and Logistics accounting for $141.1 million. On the thermal side, Northern Appalachia (NAPP) revenue totaled $61.1 million. Freight and handling revenues and other revenues were $56.0 million and $4.3 million, respectively, in the fourth quarter.

CAPP coal shipments for the fourth quarter were 0.8 million tons at an average per-ton realization of $109.09. Contura shipped 1.4 million tons of NAPP coal during the quarter at an average per-ton realization of $43.89. NAPP volumes were reduced due to a previously disclosed roof fall at the Cumberland underground longwall mine in mid-September 2017. Full production at Cumberland resumed in mid-October 2017 and the company continues to believe the production issues have been successfully mitigated. In the Trading and Logistics segment, 1.2 million tons of coal were shipped at an average price of $115.37 per ton.

For the full year, CAPP metallurgical coal shipments were 3.9 million tons at an average per-ton realization of $117.61. Contura shipped 6.9 million tons of NAPP coal at an average per-ton realization of $43.71 for the year ended December 31, 2017. In the Trading and Logistics segment, 4.9 million tons of coal were shipped at an average price of $130.23 per ton.

Total costs and expenses during the fourth quarter were $305.1 million and cost of coal sales was $247.9 million. The cost of coal sales in CAPP for the quarter averaged $76.52 per ton, including $2.01 per ton in idle costs. NAPP costs at $46.84 per ton were elevated due to the aforementioned production disruption, which impacted the longwall operation during the first two weeks of the quarter. NAPP costs included idle costs of $0.66 per ton. In the Trading and Logistics segment, the cost of coal sales during the fourth quarter was $97.62 per ton.

Total costs and expenses for the full-year period were $1.47 billion and cost of coal sales was $1.09 billion. The cost of coal sales in CAPP averaged $74.58 per ton for the year, while NAPP costs averaged $37.16 through the end of December. The cost of coal sales includes idle costs of $1.77 per ton for CAPP and $0.89 per ton for NAPP. In the Trading and Logistics segment, the cost of coal sales for the full-year period was $111.94 per ton.

Selling, general and administrative (SG&A) expenses for the fourth quarter were $11.4 million, which includes approximately $2.7 million in non-cash stock compensation and incentive bonus plans. Depreciation, depletion and amortization was $9.6 million during the fourth quarter and amortization of acquired intangibles was $9.9 million.

SG&A expenses for the full-year period were $67.5 million, which includes approximately $4.0 million of non-recurring expenses associated primarily with the company’s filing of a registration statement with the Securities and Exchange Commission (SEC), approximately $19.2 million in stock compensation (including $4.8 million related to the dividend equivalent payment) and approximately $7.4 million of charges related to the company’s incentive bonus plans. The SG&A expenses also include approximately $1.3 million of professional fees related to the special dividend. In addition, approximately $1.5 million of business development expense is included in the SG&A. Depreciation, depletion and amortization during the full-year period was $34.9 million and amortization of acquired intangibles was $59.0 million.

Contura recorded net income of $96.6 million, or $9.13 per diluted share, for the fourth quarter and net income of $154.5 million, or $14.35 per diluted share, for the full year. Net income from continuing operations was $114.6 million, or $10.83 per diluted share, for the fourth quarter and $173.7 million, or $16.13 per diluted share, for the full year. The net loss from discontinued operations was $18.0 million, or $1.70 per diluted share, for the fourth quarter and $19.2 million, or $1.78 per diluted share, for the full year. The fourth quarter and full-year results include an income tax benefit of $78.7 million due to the release of the valuation allowance previously recorded against the deferred tax assets for alternative minimum tax credit carryforwards (AMT Credits). The valuation allowance was released due to the enactment of the Tax Cuts and Jobs Act on December 22, 2017.

Total adjusted EBITDA comprised of both continuing and discontinued operations was $44.7 million for the fourth quarter. Adjusted EBITDA from continuing operations was $36.1 million for the quarter, excluding a $3.2 million adjustment related to the special dividend, $2.4 million in accretion expense and a $29.7 million gain on settlement of acquisition-related expenses. The divested PRB reporting segment is classified within discontinued operations and had adjusted EBITDA of $8.6 million. Adverse geologic conditions and the resulting production disruption at the Cumberland underground longwall mine in NAPP had an estimated fourth quarter EBITDA impact of approximately $22 million, compared to our expected results.

Full-year total adjusted EBITDA comprised of both continuing and discontinued operations was $300.2 million. Full-year EBITDA from continuing operations was $258.3 million, excluding $38.9 million gain on settlement of acquisition-related obligations, $38.7 million loss on early extinguishment of debt, $9.9 million accretion expense, $6.4 million expense related to the payout of the special dividend, $4.5 million in secondary offering costs and a $3.2 million mark-to-market adjustment for acquisition related obligations. The divested PRB reporting segment is classified within discontinued operations and had adjusted EBITDA of $41.9 million for the full year.

Liquidity and Capital Resources

Cash provided by operating activities for the fourth quarter and full-year period were $59.7 million and $305.6 million, respectively. Capital expenditures for the fourth quarter and full-year period were $26.7 million and $83.1 million, respectively. Capital expenditures include $2.3 million of PRB related expenditures in the fourth quarter and $10.4 million for the full year.

At the end of December, Contura had $141.9 million in unrestricted cash. Total long-term debt, including the current portion of long-term debt as of December 31, 2017, was approximately $372.7 million. At the end of December, the company had total liquidity of $255.6 million, including cash and cash equivalents of $141.9 million and $113.7 million of unused commitments available under the Asset-Based Revolving Credit Facility.

During the fourth quarter, the company repurchased 530,000 shares at $60.00 per share for an aggregate consideration of $31.8 million. In September 2017, Contura repurchased 309,310 of its common stock shares at $56.40 per share for a total repurchase amount of $17.4 million.

Powder River Basin Assets Divested

In December 2017, the company divested its Powder River Basin assets to Blackjewel LLC for a total deferred consideration of up to $50 million. The PRB transaction reduces the company’s reclamation obligations by $119.7 million and is expected to generate income tax deductions of approximately $450 million.

Once all permits have been transferred to the buyer, the company estimates approximately $24 million will be released from restricted cash to operating cash. In connection with the transaction, Contura paid approximately $21.4 million in exchange for the assumption of certain liabilities by the buyer and for transaction-related costs.

2018 Full-Year Guidance

The company maintains its previously announced 2018 guidance and expects total 2018 coal shipments to be in the range of 15.0 million to 16.8 million tons across all operations, including 3.7 million to 4.1 million tons of captive Central Appalachia (CAPP) metallurgical coal and an additional 4.2 million to 5.0 million tons of metallurgical coal through its Trading and Logistics segment. Northern Appalachia (NAPP) shipments, sold primarily into thermal markets, are anticipated to be between 7.1 million and 7.7 million tons in 2018.

As of March 20, 2018, 29% of the midpoint of anticipated 2018 CAPP coal shipments were committed and priced at an average expected per-ton realization of $127.60, with an additional 39% committed and either unpriced or priced based on various indices. Based on the midpoint of guidance, 97% of anticipated 2018 NAPP coal shipments were committed and priced at an average expected per-ton realization of $42.23.

Contura expects its 2018 CAPP cost of coal sales per ton to range from $68.00 to $73.00. NAPP cost estimates are projected to be between $29.00 to $33.00 per ton. Additionally, costs related to the company’s idle operations are expected to be between $10 million and $12 million for full-year 2018.

The margin from Contura’s Trading and Logistics platform is expected to average $9 to $15 per ton for the full-year 2018.

Contura’s capital expenditures for 2018 are expected to be in the range of $64 million to $74 million, while SG&A guidance is estimated at $32 million to $36 million, excluding one-time and non-recurring items, annual incentive bonus and stock compensation. Depreciation, depletion and amortization for 2018 is expected to be between $40 million and $50 million. The company expects 2018 cash interest expense to be between $25 million and $27 million.

| in millions of tons | Low | High |

|---|---|---|

| CAPP | 3.7 | 4.1 |

| NAPP | 7.1 | 7.7 |

| Total Production | 10.8 | 11.8 |

| Contura Trading & Logistics | 4.2 | 5.0 |

| Total Shipments | 15.0 | 16.8 |

Committed/Priced [1][2][3]| Committed | Average Price |

|

|---|---|---|

| CAPP[4] | 29% | $127.60 |

| NAPP | 97% | $42.23 |

| Committed/Unpriced[1][3] | Committed |

|---|---|

| CAPP[4] | 39% |

| Costs per ton | Low | High |

|---|---|---|

| CAPP | $68.00 | $73.00 |

| NAPP | $29.00 | $33.00 |

| Margin per ton | Low | High |

|---|---|---|

| Contura Trading & Logistics | $9 | $15 |

In millions (except taxes)| Low | High |

|

|---|---|---|

| SG&A[5] | $32 | $36 |

| Idle Operations Expense | $10 | $12 |

| Cash Interest Expense | $25 | $27 |

| DD&A | $40 | $50 |

| Capital Expenditures | $64 | $74 |

| Tax Rate | 0% | 5% |

Notes:

[1] Based on committed and priced coal shipments as of March 20, 2018. Committed percentage based on the midpoint of shipment guidance range.

[2] Actual average per ton realizations on committed and priced tons recognized in future periods may vary based on actual freight expense in future periods relative to assumed freight expense embedded in projected average per-ton realizations.

[3] Includes estimates of future coal shipments based upon contract terms and anticipated delivery schedules. Actual coal shipments may vary from these estimates.

[4] CAPP committed tons and price information represent captive Contura production and does not include Trading and Logistics.

[5] Excludes expenses related to non-cash stock compensation, accrual of incentive bonus and non-recurring business development expenses.

Additional Information

For additional financial information about Contura, please visit www.conturaenergy.com/financials.

ABOUT CONTURA ENERGY

Contura Energy is a private, Tennessee-based coal supplier with affiliate mining operations across major coal basins in Pennsylvania, Virginia and West Virginia. With customers across the globe, high-quality reserves and significant port capacity, Contura Energy reliably supplies both metallurgical coal to produce steel and thermal coal to generate power. For more information, visit www.conturaenergy.com.

FORWARD-LOOKING STATEMENTS

This news release includes forward-looking statements. These forward-looking statements are based on Contura’s expectations and beliefs concerning future events and involve risks and uncertainties that may cause actual results to differ materially from current expectations. These factors are difficult to predict accurately and may be beyond Contura’s control. Forward-looking statements in this news release or elsewhere speak only as of the date made. New uncertainties and risks arise from time to time, and it is impossible for Contura to predict these events or how they may affect Contura. Except as required by law, Contura has no duty to, and does not intend to, update or revise the forward-looking statements in this news release or elsewhere after the date this release is issued. In light of these risks and uncertainties, investors should keep in mind that results, events or developments discussed in any forward-looking statement made in this news release may not occur.

FINANCIAL TABLES FOLLOW

Use of Non-GAAP Measures

In addition to the results prepared in accordance with generally accepted accounting principles in the United States (GAAP) provided throughout this press release, Contura has presented the following non-GAAP financial measure: Adjusted EBITDA. The company uses Adjusted EBITDA to measure the operating performance of its segments and allocate resources to the segments. This non-GAAP financial measure excludes various items detailed in the attached reconciliation tables.

The definition of this non-GAAP measure may be changed periodically by management to adjust for significant items important to an understanding of operating trends. This measure is not intended to replace financial performance measures determined in accordance with GAAP. Rather, it is presented as a supplemental measure of the company’s performance that management finds useful in assessing the company’s financial performance and believes is useful to securities analysts, investors and others in assessing the company’s performance over time. Moreover, this measure is not calculated identically by all companies and therefore may not be comparable to similarly titled measures used by other companies.

CONTURA ENERGY, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF OPERATIONS AND PREDECESSOR COMBINED STATEMENTS OF OPERATIONS

(Amounts in thousands, except share and per share data)

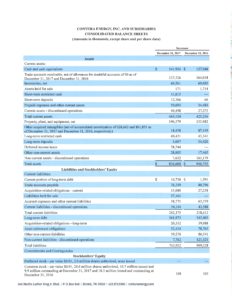

CONTURA ENERGY, INC. AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS

(Amounts in thousands, except share and per share data)

CONTURA ENERGY, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF CASH FLOWS AND PREDECESSOR COMBINED STATEMENTS OF CASH FLOWS

(Amounts in thousands)

CONTURA ENERGY, INC. AND SUBSIDIARIES ADJUSTED EBITDA RECONCILIATION

(Amounts in thousands)

CONTURA ENERGY, INC. AND SUBSIDIARIES RESULTS OF OPERATIONS

(Amounts in thousands, except per ton data)