Contura Announces First Quarter 2020 Results

• Reports net loss from continuing operations of $40 million for the first quarter 2020, including a pre-tax non-cash asset impairment charge of $34 million

• Posts impressive adjusted EBITDA(1) of $60 million for the first quarter 2020

• Continues very strong cost management with CAPP – Met costs declining more than $10 per ton compared to the fourth quarter of 2019

• Reports liquidity of $257 million and expects to receive $68 million in accelerated AMT tax refund by early third quarter

• Announces prestigious safety and environmental awards earned by Contura operations

BRISTOL, Tenn., May 11, 2020 – Contura Energy, Inc. (NYSE: CTRA), a leading U.S. coal supplier, today reported results for the first quarter ending March 31, 2020.

(millions, except per share)

Three months ended Mar. 31, 2020(2) Three months ended Dec. 31, 2019(2) Three months ended Mar. 31, 2019(2)

Net (loss) income(3) $(39.8) $(191.9) $6.8

Net (loss) income(3) per diluted share $(2.18) $(10.54) $0.41

Adjusted EBITDA(1) $60.2 $31.5 $83.4

Operating cash flow(4) $(0.1) $(5.7) $14.6

Capital expenditures $(49.6) $(48.2) $(41.1)

Tons of coal sold 5.5 5.7 5.9

1. These are non-GAAP financial measures. A reconciliation of Net Income to Adjusted EBITDA is included in tables accompanying the financial schedules.

2. Excludes discontinued operations, except as noted.

3. From continuing operations. First quarter 2020 no longer has discontinued operations.

4. Includes discontinued operations. First quarter 2020 no longer has discontinued operations.

“Among the most significant takeaways from Contura’s first quarter was our team’s standout performance controlling costs,” said chairman and chief executive officer, David Stetson. “Despite the unexpected headwinds and uncertainty of the coronavirus pandemic, we were still able to deliver on our operational cost containment goals which resulted in a superb quarter with strong EBITDA.”

Jason Whitehead, Contura’s chief operating officer, commented on the exceptional cost performance for the quarter saying, “I’m proud to announce that our operations teams continued to build on our enhanced productivity measures, with our CAPP – Met cost per ton reaching multi-year lows during the quarter. We are also back to full staffing and operation as of May 4 with nearly all of our previously-furloughed employees having returned to work.”

Financial Performance

Contura reported a net loss from continuing operations of $39.8 million, or $2.18 per diluted share, for the first quarter 2020. The first quarter loss includes a pre-tax, non-cash asset impairment charge of $33.7 million. In the fourth quarter 2019, the company had a net loss from continuing operations, including non-cash asset and goodwill impairment charges, of $191.9 million or $10.54 per diluted share.

Total Adjusted EBITDA improved to $60.2 million for the first quarter, compared with $31.5 million in the fourth quarter, primarily due to strong CAPP – Met cost performance.

Coal Revenues

(millions) Three months ended Mar. 31, 2020 Three months ended Dec. 31, 2019

CAPP - Met $362.4 $370.2

CAPP - Thermal $38.7 $60.6

NAPP $66.9 $65.8

CAPP - Met (excl. f&h)(1) $308.7 $310.9

CAPP - Thermal (excl. f&h)(1) $35.0 $50.1

NAPP - (excl. f&h)(1) $64.6 $62.4

Tons Sold (millions) Three months ended Mar. 31, 2020 Three months ended Dec. 31, 2019

CAPP - Met 3.3 3.3

CAPP - Thermal 0.6 0.9

NAPP 1.5 1.5

1. Represents Non-GAAP coal revenues which is defined and reconciled under “Non-GAAP Financial Measures” and “Results of Operations.”

The slight CAPP – Met revenue decline in the first quarter was driven by a 2 percent decline in price realizations relative to the fourth quarter, while CAPP – Thermal revenues declined as a result of a 31 percent reduction in tons sold. In the NAPP segment, the first quarter revenues were essentially flat as compared to the fourth quarter.

Coal Sales Realization(1)

(per ton) Three months ended Mar. 31, 2020 Three months ended Dec. 31, 2019

CAPP - Met $92.80 $94.98

CAPP - Thermal $56.73 $56.13

NAPP $42.81 $41.17

1. Represents Non-GAAP coal sales realization which is defined and reconciled under “Non-GAAP Financial Measures” and “Results of Operations.”

Following a soft second half of 2019 for metallurgical coal, the first quarter 2020 metallurgical coal prices stabilized somewhat with our average CAPP – Met coal sales realization declining 2 percent to $92.80 per ton against the prior quarter. The primary driver of lower first quarter realization was our domestic business, where our annual contracted pricing is below 2019 levels. Thermal coal price realizations were fractionally up in the first quarter for both CAPP – Thermal and NAPP segments.

Cost of Coal Sales

(in millions, except per ton data) Three months ended Mar. 31, 2020 Three months ended Dec. 31, 2019

Cost of Coal Sales $397.9 $444.6

Cost of Coal Sales (excl. f&h/idle)(1) $328.1 $366.4

(per ton) Three months ended Mar. 31, 2020 Three months ended Dec. 31, 2019

CAPP - Met(1) $70.68 $82.26

CAPP - Thermal(1) $53.07 $49.21

NAPP(1) $39.68 $34.67

1.Represents Non-GAAP cost of coal sales per ton which is defined and reconciled under “Non-GAAP Financial Measures” and “Results of Operations.”

In the first quarter, Contura achieved another strong improvement in its CAPP – Met segment cost performance with costs declining from $82.26 per ton in the fourth quarter to $70.68 per ton in the first quarter of 2020. Our productivity continued to show meaningful improvements in the first quarter 2020 with our deep mines in the CAPP – Met region realizing a 9 percent increase in feet per shift compared with the prior quarter.

NAPP cost of coal sales for the quarter was impacted by a longwall move in March, resulting in an approximately $5 per ton increase in costs. CAPP – Thermal cost of coal sales per ton was higher primarily due to reduced volume.

Selling, general and administrative (SG&A) and depreciation, depletion and amortization (DD&A) expenses

(millions) Three months ended Mar. 31, 2020 Three months ended Dec. 31, 2019

SG&A $15.5 $25.8

Less: non-cash stock compensation and one-time expenses $(2.1) $(12.7)

Non-GAAP SG&A(1) $13.4 $13.1

DD&A $54.5 $43.9

1.Represents Non-GAAP SG&A which is defined under “Non-GAAP Financial Measures.”

Contura’s first quarter 2020 SG&A expenses of $13.4 million, excluding non-cash stock compensation expense and one-time expenses of $2.1 million, was virtually flat as compared to the prior quarter.

Liquidity and Capital Resources

“As we continue managing through the uncertainty created by the COVID-19 pandemic and its impact on the global economy, we believe cash preservation is of utmost importance for the near term,” said Andy Eidson, Contura’s chief financial officer. “Our previously-announced draw of $57.5 million on our revolver in late March was a proactive and precautionary measure we took to provide flexibility. As a result of the CARES Act, we now anticipate an acceleration of the previously-disclosed AMT tax refund, which we expect to be approximately $68 million early in the third quarter of this year and an additional $14 million of payroll tax deferrals until 2021 and 2022.”

Cash used in operating activities for the first quarter 2020 was $0.1 million and capital expenditures for the first quarter were $49.6 million. In the prior period, the cash used in operating activities was $5.7 million and capital expenditures were $48.2 million.

As of March 31, 2020, Contura had $227.1 million in unrestricted cash and $155.8 million in restricted cash, deposits and investments. Total long-term debt, including the current portion of long-term debt as of March 31, 2020, was approximately $653.0 million. At the end of the first quarter, the company had total liquidity of $257.1 million, including cash and cash equivalents of $227.1 million and $30.0 million of unused commitments available under the Asset-Based Revolving Credit Facility. The future available capacity under the Asset-Based Revolving Credit Facility is subject to inventory and accounts receivable collateral requirements and the achievement of certain financial ratios. As of March 31, 2020, the company had $57.5 million in borrowings and $119.7 million in letters of credit outstanding under the Asset-Based Revolving Credit Facility.

Safety and Environmental Awards

Safety and environmental stewardship are critically important to our everyday operations, and Contura is proud to announce that several of our operations have earned awards in recognition of their achievements. The West Virginia State Council of the Joseph A. Holmes Safety Association has notified the following operations that they will be receiving a safety award from the Council at a presentation ceremony later this year: Kingston #1, Black Eagle, Panther Eagle, Allen Powellton, and Elk Run. In addition to the Council’s Safety Special Recognition award, the Elk Run line crew has reached a significant milestone of having worked since its inception in 1985 without a single lost time injury. We congratulate them on 35 years of outstanding safety performance.

On the environmental side, the company’s Bull Run Surface Mine has been notified that it will receive the 2019 Virginia State Award for Excellence in Reforestation from the Appalachian Regional Reforestation Initiative, which will be formally presented later in the year.

Temporary Operational Changes Update

As we announced on April 3, certain operations were temporarily idled in response to market conditions, inventory levels and expected customer deferrals. These temporary idlings have since been completed or shortened, and as of May 4, all Contura sites are back to nearly normal staffing levels and operating capacity with additional precautions in place to help reduce the risk of exposure to COVID-19.

Conference Call

The company plans to hold a conference call regarding its first quarter 2020 results on May 11, 2020, at 10:00 a.m. Eastern time. The conference call will be available live on the investor section of the company’s website at https://investors.conturaenergy.com/investors. Analysts who would like to participate in the conference call should dial 866-270-1533 (domestic toll-free) or 412-317-0797 (international) approximately 10 minutes prior to the start of the call.

ABOUT CONTURA ENERGY

Contura Energy (NYSE: CTRA) is a Tennessee-based coal supplier with affiliate mining operations across major coal basins in Pennsylvania, Virginia and West Virginia. With customers across the globe, high-quality reserves and significant port capacity, Contura Energy reliably supplies both metallurgical coal to produce steel and thermal coal to generate power. For more information, visit www.conturaenergy.com.

FORWARD-LOOKING STATEMENTS

This news release includes forward-looking statements. These forward-looking statements are based on Contura’s expectations and beliefs concerning future events and involve risks and uncertainties that may cause actual results to differ materially from current expectations. These factors are difficult to predict accurately and may be beyond Contura’s control. Forward-looking statements in this news release or elsewhere speak only as of the date made. New uncertainties and risks arise from time to time, and it is impossible for Contura to predict these events or how they may affect Contura. Except as required by law, Contura has no duty to, and does not intend to, update or revise the forward-looking statements in this news release or elsewhere after the date this release is issued. In light of these risks and uncertainties, investors should keep in mind that results, events or developments discussed in any forward-looking statement made in this news release may not occur.

FINANCIAL TABLES FOLLOW

Non-GAAP Financial Measures

The discussion below contains “non-GAAP financial measures.” These are financial measures which either exclude or include amounts that are not excluded or included in the most directly comparable measures calculated and presented in accordance with generally accepted accounting principles in the United States (“U.S. GAAP” or “GAAP”). Specifically, we make use of the non-GAAP financial measures “Adjusted EBITDA,” “non-GAAP coal revenues,” “non-GAAP cost of coal sales,” and “Adjusted cost of produced coal sold.” We use Adjusted EBITDA to measure the operating performance of our segments and allocate resources to the segments. Adjusted EBITDA does not purport to be an alternative to net income (loss) as a measure of operating performance. We use non-GAAP coal revenues to present coal revenues generated, excluding freight and handling fulfillment revenues. Non-GAAP coal sales realization per ton for our operations is calculated as non-GAAP coal revenues divided by tons sold. We use non-GAAP cost of coal sales to adjust cost of coal sales to remove freight and handling costs, idled and closed mine costs and coal inventory acquisition accounting impacts. Non-GAAP cost of coal sales per ton for our operations is calculated as non-GAAP cost of coal sales divided by tons sold. Non-GAAP coal margin per ton for our coal operations is calculated as non-GAAP coal sales realization per ton for our coal operations less non-GAAP cost of coal sales per ton for our coal operations. We also use Adjusted cost of produced coal sold to distinguish the cost of captive produced coal from the effects of purchased coal. The presentation of these measures should not be considered in isolation, or as a substitute for analysis of our results as reported under GAAP.

Management uses non-GAAP financial measures to supplement GAAP results to provide a more complete understanding of the factors and trends affecting the business than GAAP results alone. The definition of these non-GAAP measures may be changed periodically by management to adjust for significant items important to an understanding of operating trends and to adjust for items that may not reflect the trend of future results by excluding transactions that are not indicative of our core operating performance. Furthermore, analogous measures are used by industry analysts to evaluate the Company’s operating performance. Because not all companies use identical calculations, the presentations of these measures may not be comparable to other similarly titled measures of other companies and can differ significantly from company to company depending on long-term strategic decisions regarding capital structure, the tax jurisdictions in which companies operate, and capital investments.

Included below are reconciliations of non-GAAP financial measures to GAAP financial measures.

CONTURA ENERGY, INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited)

(Amounts in thousands, except share and per share data)

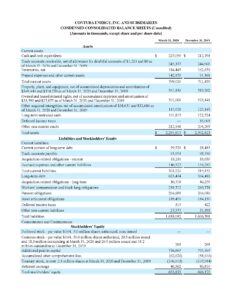

CONTURA ENERGY, INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED BALANCE SHEETS (Unaudited)

(Amounts in thousands, except share and per share data)

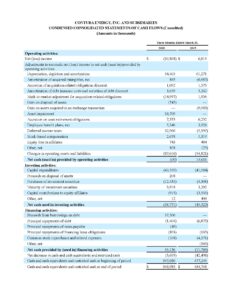

CONTURA ENERGY, INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited)

(Amounts in thousands)

CONTURA ENERGY, INC. AND SUBSIDIARIES ADJUSTED EBITDA RECONCILIATION

(Amounts in thousands)

CONTURA ENERGY, INC. AND SUBSIDIARIES RESULTS OF OPERATIONS

(In thousands, except for per ton data)