Alpha Reports Second Quarter 2022 Financial Results

CEO Stetson Announces Planned Transition to Executive Board Chairman at Year End; President and CFO Eidson to Assume CEO Role

• Provides details on succession roadmap for Stetson’s end of year planned retirement

• Reports second quarter net income from continuing operations of $575.4 million

• Posts record Adjusted EBITDA of $694.5 million for the second quarter 2022

• Eliminates remaining term-loan balance in June, effectively freeing the company of long-term debt

• Reports $268 million in buybacks through share repurchase program

• Increases quarterly dividend amount to 39.2 cents per share

• Adjusts full-year guidance upward for byproduct thermal shipments from the Met segment and SG&A

BRISTOL, Tenn., August 8, 2022 – Alpha Metallurgical Resources, Inc. (NYSE: AMR), a leading U.S. supplier of metallurgical products for the steel industry, today reported results for the second quarter ending June 30, 2022.

(millions, except per share)

| Three months ended June 30, 2022 | Three months ended Mar. 31, 2022 | Three months ended June 30, 2021 | |

|---|---|---|---|

| Net income (loss)(2) | $575.4 | $401.0 | ($18.6) |

| Net income (loss)(2) per diluted share | $30.03 | $20.52 | ($1.01) |

| Adjusted EBITDA(1) | $694.5 | $503.8 | $39.9 |

| Operating cash flow(3) | $465.9 | $336.1 | ($6.3) |

| Capital expenditures(3) | ($41.9) | ($28.1) | ($17.6) |

| Tons of coal sold(2) | 4.3 | 4.0 | 4.0 |

__________________________________

1. These are non-GAAP financial measures. A reconciliation of Net Income to Adjusted EBITDA is included in tables accompanying the financial schedules.

2. From continuing operations.

3. Includes discontinued operations.

“After meeting our stated goal of paying off the long-term debt, the Alpha team has posted yet another record quarter, with Adjusted EBITDA of nearly $700 million,” said David Stetson, Alpha’s chair and chief executive officer. “Eliminating the debt was a key goal of mine because I believed it would create a more stable company with the flexibility to weather the inevitable market volatility that this industry experiences. The fact that we were able to pay off the debt in such a short period of time is a testament not only to the strength of the recent coal markets but also to the steadfast resolve and discipline of our team.”

Stetson continued: “With these recent accomplishments, Alpha has entered a new and exciting chapter, and I believe the end of this calendar year is the right time to hand over the reins of day-to-day leadership of the company to Andy Eidson. Like most public companies, Alpha’s board of directors and executive management routinely engage in succession planning to prepare for and effectively handle leadership transitions. Andy and I have therefore worked together closely for many years. Now, as I prepare for retirement, we will focus on a seamless transition. He is exceedingly well prepared to take on the CEO role, and his vision for the company is an extension of what we have demonstrated the last few years – financial discipline, excellence and reliability in all aspects of our work, and a firm commitment to creating and maintaining shareholder value. It has been my great honor to lead Alpha, and I look forward to continuing my involvement as executive chairman of the board of directors.”

Financial Performance

For the second quarter 2022, Alpha reported net income from continuing operations of $575.4 million, or $30.03 per diluted share. The company had net income from continuing operations of $401.0 million or $20.52 per diluted share for the first quarter 2022.

Total Adjusted EBITDA for the second quarter was a record $694.5 million, compared with $503.8 million in the first quarter 2022.

Coal Revenues

| (millions) | Three months ended June 30, 2022 | Three months ended Mar. 31, 2022 |

|---|---|---|

| Met Segment | $1,318.7 | $1,054.3 |

| All Other | $15.6 | $15.4 |

| Met Segment (excl. freight & handling)(1) | $1,162.1 | $910.3 |

| All Other (excl. freight & handling)(1) | $15.6 | $15.4 |

Tons Sold

| (millions) | Three months ended June 30, 2022 | Three months ended Mar. 31, 2022 |

|---|---|---|

| Met Segment | 4.1 | 3.8 |

| All Other | 0.3 | 0.3 |

__________________________________

1. Represents Non-GAAP coal revenues which is defined and reconciled under “Non-GAAP Financial Measures” and “Results of Operations.”

Coal Sales Realization(1)

| (per ton) | Three months ended June 30, 2022 | Three months ended Mar. 31, 2022 |

|---|---|---|

| Met Segment | $286.95 | $240.82 |

| All Other | $61.41 | $57.39 |

__________________________________

1. Represents Non-GAAP coal sales realization which is defined and reconciled under “Non-GAAP Financial Measures” and “Results of Operations.”

Our net realized pricing for the Met segment was $286.95 per ton in the second quarter 2022, while net realization in the All Other category was $61.41.

The table below provides a breakdown of our Met segment coal sold in the second quarter by pricing mechanism.

(in millions, except per ton data)

Three months ended June 30, 2022

| Met Segment Sales | Tons Sold | Coal Revenues | Realization/ton(1) | % of Met Tons Sold |

|---|---|---|---|---|

| Export - Other Pricing Mechanisms | 1.3 | $417.0 | $321.03 | 35% |

| Domestic | 0.8 | $159.7 | $189.27 | 22% |

| Export - Australian Indexed | 1.6 | $565.1 | $350.56 | 43% |

| Total Met Coal Revenues | 3.8 | $1,141.9 | $304.09 | 100% |

| Thermal Coal Revenues | 0.3 | $20.3 | $68.75 | |

| Total Met Segment Coal Revenues (excl. freight & handling)(1) | 4.1 | $1,162.2 | $286.95 |

__________________________________

1. Represents Non-GAAP coal sales realization which is defined and reconciled under “Non-GAAP Financial Measures” and “Results of Operations.”

Cost of Coal Sales

| (in millions, except per ton data) | Three months ended June 30, 2022 | Three months ended Mar. 31, 2022 |

|---|---|---|

| Cost of Coal Sales | $625.9 | $555.3 |

| Cost of Coal Sales (excl. freight & handling/idle)(1) | $463.7 | $405.0 |

| (per ton) | Three months ended June 30, 2022 | Three months ended Mar. 31, 2022 |

|---|---|---|

| Met Segment(1) | $111.36 | $103.61 |

| All Other(1) | $49.90 | $49.89 |

__________________________________

1. Represents Non-GAAP cost of coal sales and Non-GAAP cost of coal sales per ton which is defined and reconciled under “Non-GAAP Financial Measures” and “Results of Operations.”

In the second quarter, Alpha’s Met segment cost of coal sales increased to an average of $111.36 per ton as compared to $103.61 per ton in the prior quarter, primarily driven by increased sales related costs from royalties and severance taxes. Cost of coal sales for the All Other category remained flat at $49.90 per ton in the second quarter 2022 against an average cost of $49.89 per ton in the first quarter 2022.

Liquidity and Capital Resources

On June 3, 2022, Alpha made a voluntary prepayment of $99.4 million on its term loan, which eliminated all remaining principal and paid the loan in full.

As previously announced, in connection with Alpha’s improved financial position, the company received a reduction of $40.1 million in collateral requirements related to its self-insured workers compensation at certain locations in West Virginia. Additionally, as part of routine surety program review and negotiation, the company received a $16.5 million reduction in surety collateral requirements, while securing multi-year visibility on surety program terms and conditions.

“Thanks to the strength of the metallurgical market in the first half of the year, we fully eliminated our term loan balance, further enhancing our balance sheet,” said Andy Eidson, Alpha’s president and chief financial officer. “As a result of this good work, we have also received a reduction in collateral requirements and visibility into surety terms and conditions for the coming years. Additionally, Alpha’s corporate family rating was recently upgraded due in large part to our discipline in eliminating the debt. These are all positive developments for the company and our many stakeholders.”

Cash provided by operating activities in the second quarter significantly increased to $465.9 million as compared to $336.1 million in the first quarter 2022. Cash provided by operating activities includes discontinued operations. Capital expenditures for the second quarter 2022 were $41.9 million compared to $28.1 million for the first quarter of 2022.

As of June 30, 2022, Alpha had $161.7 million in unrestricted cash and $130.9 million in restricted cash, deposits and investments. Total long-term debt, including the current portion of long-term debt as of June 30, 2022, was $4.7 million. At the end of the second quarter, the company had total liquidity of $252.8 million, including cash and cash equivalents of $161.7 million and $91.1 million of unused availability under the ABL. The future available capacity under the ABL is subject to inventory and accounts receivable collateral requirements and the maintenance of certain financial ratios. As of June 30, 2022, the company had no borrowings and $63.9 million in letters of credit outstanding under the ABL.

Dividend Program

On August 4, 2022, Alpha’s board declared a quarterly cash dividend payment of $0.392 per share, increased from the prior level of $0.375 per share, which will become payable on October 3, 2022 for holders of record as of September 15, 2022.

Any decision to pay future cash dividends will be made by the board and depend on Alpha’s future earnings and financial condition and other relevant factors.

Executive Leadership Succession

Alpha announced today that its chair and chief executive officer, David Stetson, will retire as chief executive officer effective December 31, 2022. Alpha’s board of directors has unanimously appointed Mr. Stetson as executive chairman of the board, effective at year end. The board has unanimously appointed president and chief financial officer Andy Eidson to succeed Mr. Stetson as chief executive officer and as a member of the board of directors, effective January 1, 2023 following Mr. Stetson’s retirement as CEO at year end.

The board of directors also unanimously approved the following additional leadership changes: Effective August 9, 2022, Alpha’s senior vice president and controller, Todd Munsey, will be promoted to executive vice president and chief financial officer. Mr. Eidson’s service as chief financial officer will end at the time of Mr. Munsey’s appointment, allowing him to focus as president on his transition to the role of chief executive officer. Effective January 1, 2023, current executive vice president and chief operating officer Jason Whitehead will become Alpha’s president and chief operating officer.

Lead independent director, Michael Quillen, offered the following statement on Stetson’s retirement and Eidson’s appointment: “On behalf of the board, we want to thank David Stetson for the exceptional job he has done in leading Alpha. He has guided the executive team in overcoming many hurdles to build the outstanding company that is today announcing yet another record quarter. Having accomplished the goals he set forth when he came on board, David understandably wants to begin transitioning into retirement, and we wish him well in this new phase of life. We are grateful for the opportunity to retain his expertise and vision as executive chairman of the board. Additionally, the board is excited about Andy Eidson’s appointment as Alpha’s next CEO. He is not only exceptionally capable of building on the firm foundation that David has created, Andy is also bright, well-qualified, and brings a valuable perspective that can help propel Alpha into its next chapter as a more resilient company.”

Andy Eidson commented on today’s announcement: “I cannot thank David enough for all he has done for Alpha. I can attest to the lasting impact he has made, not only on this company, but also on me, through his leadership and vision. It has been a great honor to be a part of his executive team, and I look forward to continuing the positive momentum he created. I am humbled by the opportunity to serve as Alpha’s next chief executive, and, together with the exceptional people in this organization, I will strive toward continuous improvement, safe production each and every day, and further solidifying Alpha’s role as the industry leader. I thank the board for the confidence they have shown by offering me this opportunity and I look forward to the path ahead.”

Quillen continued: “The board has great confidence in Jason Whitehead as he expands his role to include serving as the company’s president, and in Todd Munsey as he takes over the reins as chief financial officer. Both individuals are highly qualified and will continue to serve Alpha well in their new roles. All in all, we believe Alpha continues to be positioned for long-term success with an outstanding, experienced, and industry-leading management team.”

Share Repurchase Program

As previously announced, Alpha’s board of directors authorized a share repurchase program allowing for the expenditure of up to $600 million for the repurchase of the company’s common stock. As of August 5, the company has acquired 1,892,954 shares of common stock at a cost of $268.0 million.

The timing and amount of share repurchases will continue to be determined by the company’s management based on its evaluation of market conditions, the trading price of the stock, applicable legal requirements, compliance with the provisions of the company’s debt agreements, and other factors.

2022 Full-Year Guidance Adjustments

“As a result of the European energy crisis caused by the Russian war, the thermal coal markets have shown significant volatility and increasing demand in recent months,” said Jason Whitehead, executive vice president and chief operating officer. “We fulfilled some customer requests for incremental thermal tonnage in the second quarter, which has pushed our expected total thermal volumes over the established guidance ranges for the year. Therefore, we are adjusting our shipment guidance to accommodate for these unique circumstances. Additionally, as a result of increased incentive compensation due to performance against budgeted metrics, we are increasing our guidance for selling, general and administrative expenses for the year.”

Alpha is increasing SG&A guidance to a range of $55 million and $59 million, up from the prior range of $50 million to $54 million.

The company is increasing its shipment guidance for thermal byproduct tonnage within the Met segment to a range of 1.0 million to 1.4 million tons, up from the prior guidance range of 0.8 million tons to 1.2 million tons. This adjustment also slightly increases the total shipments guidance to a range of 15.6 million tons to 17.2 million tons, up from the prior range of 15.4 million to 17.0 million tons.

As of July 22, 2022, Alpha has committed and priced approximately 69% of its metallurgical coal within the Met segment at an average price of $260.69 per ton and 100% of thermal coal in the Met segment at an average expected price of $89.91 per ton. In the All Other category the company is 100% committed and priced at an average price of $83.38 per ton.

2022 Guidance

| in millions of tons | Low | High |

|---|---|---|

| Metallurgical | 14.0 | 15.0 |

| Thermal | 1.0 | 1.4 |

| Met Segment | 15.0 | 16.4 |

| All Other | 0.6 | 0.8 |

| Total Shipments | 15.6 | 17.2 |

| Committed/Priced1,2,3 | Committed | Average Price |

|---|---|---|

| Metallurgical - Domestic | $189.87 | |

| Metallurgical - Export | $303.51 | |

| Metallurgical Total | 69% | $260.69 |

| Thermal | 100% | $89.91 |

| Met Segment | 73% | $240.42 |

| All Other | 100% | $83.38 |

| Committed/Unpriced1,3 | Committed | |

|---|---|---|

| Metallurgical Total | 29% | |

| Thermal | --% | |

| Met Segment | 27% | |

| All Other | --% |

| Costs per ton4 | Low | High |

|---|---|---|

| Met Segment | $101.00 | $107.00 |

| All Other | $58.00 | $62.00 |

| In millions (except taxes) | Low | High |

|---|---|---|

| SG&A5 | $55 | $59 |

| Idle Operations Expense | $30 | $40 |

| Cash Interest Expense | $18 | $22 |

| DD&A | $90 | $110 |

| Capital Expenditures | $160 | $190 |

| Tax Rate6 | 5% | 15% |

Notes:

1. Based on committed and priced coal shipments as of July 22, 2022. Committed percentage based on the midpoint of shipment guidance range.

2. Actual average per-ton realizations on committed and priced tons recognized in future periods may vary based on actual freight expense in future periods relative to assumed freight expense embedded in projected average per-ton realizations.

3. Includes estimates of future coal shipments based upon contract terms and anticipated delivery schedules. Actual coal shipments may vary from these estimates.

4. Note: The Company is unable to present a quantitative reconciliation of its forward-looking non-GAAP cost of coal sales per ton sold financial measures to the most directly comparable GAAP measures without unreasonable efforts due to the inherent difficulty in forecasting and quantifying with reasonable accuracy significant items required for the reconciliation. The most directly comparable GAAP measure, GAAP cost of sales, is not accessible without unreasonable efforts on a forward-looking basis. The reconciling items include freight and handling costs, which are a component of GAAP cost of sales. Management is unable to predict without unreasonable efforts freight and handling costs due to uncertainty as to the end market and FOB point for uncommitted sales volumes and the final shipping point for export shipments. These amounts have historically varied and may continue to vary significantly from quarter to quarter and material changes to these items could have a significant effect on our future GAAP results.

5. Excludes expenses related to non-cash stock compensation and non-recurring expenses.

6. Rate assumes no further ownership change limitations on the usage of net operating losses.

Conference Call

The company plans to hold a conference call regarding its second quarter 2022 results on August 8, 2022, at 10:00 a.m. Eastern time. The conference call will be available live on the investor section of the company’s website at https://investors.alphametresources.com/investors. Analysts who would like to participate in the conference call should dial 877-407-0832 (domestic toll-free) or 201-689-8433 (international) approximately 15 minutes prior to start time.

About Alpha Metallurgical Resources

Alpha Metallurgical Resources (NYSE: AMR) is a Tennessee-based mining company with operations across Virginia and West Virginia. With customers across the globe, high-quality reserves and significant port capacity, Alpha reliably supplies metallurgical products to the steel industry. For more information, visit www.AlphaMetResources.com.

Forward-Looking Statements

This news release includes forward-looking statements. These forward-looking statements are based on Alpha’s expectations and beliefs concerning future events and involve risks and uncertainties that may cause actual results to differ materially from current expectations. These factors are difficult to predict accurately and may be beyond Alpha’s control. Forward-looking statements in this news release or elsewhere speak only as of the date made. New uncertainties and risks arise from time to time, and it is impossible for Alpha to predict these events or how they may affect Alpha. Except as required by law, Alpha has no duty to, and does not intend to, update or revise the forward-looking statements in this news release or elsewhere after the date this release is issued. In light of these risks and uncertainties, investors should keep in mind that results, events or developments discussed in any forward-looking statement made in this news release may not occur.

FINANCIAL TABLES FOLLOW

Non-GAAP Financial Measures

The discussion below contains “non-GAAP financial measures.” These are financial measures which either exclude or include amounts that are not excluded or included in the most directly comparable measures calculated and presented in accordance with generally accepted accounting principles in the United States (“U.S. GAAP” or “GAAP”). Specifically, we make use of the non-GAAP financial measures “Adjusted EBITDA,” “non-GAAP coal revenues,” “non-GAAP cost of coal sales,” “non-GAAP coal margin,” and “Adjusted cost of produced coal sold.” We use Adjusted EBITDA to measure the operating performance of our segments and allocate resources to the segments. Adjusted EBITDA does not purport to be an alternative to net income (loss) as a measure of operating performance or any other measure of operating results or liquidity presented in accordance with GAAP. We use non-GAAP coal revenues to present coal revenues generated, excluding freight and handling fulfillment revenues. Non-GAAP coal sales realization per ton for our operations is calculated as non-GAAP coal revenues divided by tons sold. We use non-GAAP cost of coal sales to adjust cost of coal sales to remove freight and handling costs, depreciation, depletion and amortization – production (excluding the depreciation, depletion and amortization related to selling, general and administrative functions), accretion on asset retirement obligations, amortization of acquired intangibles, net, and idled and closed mine costs. Non-GAAP cost of coal sales per ton for our operations is calculated as non-GAAP cost of coal sales divided by tons sold. Non-GAAP coal margin per ton for our coal operations is calculated as non-GAAP coal sales realization per ton for our coal operations less non-GAAP cost of coal sales per ton for our coal operations. We also use Adjusted cost of produced coal sold to distinguish the cost of captive produced coal from the effects of purchased coal. The presentation of these measures should not be considered in isolation, or as a substitute for analysis of our results as reported under GAAP.

Management uses non-GAAP financial measures to supplement GAAP results to provide a more complete understanding of the factors and trends affecting the business than GAAP results alone. The definition of these non-GAAP measures may be changed periodically by management to adjust for significant items important to an understanding of operating trends and to adjust for items that may not reflect the trend of future results by excluding transactions that are not indicative of our core operating performance. Furthermore, analogous measures are used by industry analysts to evaluate the Company’s operating performance. Because not all companies use identical calculations, the presentations of these measures may not be comparable to other similarly titled measures of other companies and can differ significantly from company to company depending on long-term strategic decisions regarding capital structure, the tax jurisdictions in which companies operate, and capital investments.

Included below are reconciliations of non-GAAP financial measures to GAAP financial measures.

ALPHA METALLURGICAL RESOURCES, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited)

(Amounts in thousands, except share and per share data)

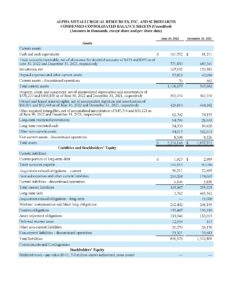

ALPHA METALLURGICAL RESOURCES, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS (Unaudited)

(Amounts in thousands, except share and per share data)

ALPHA METALLURGICAL RESOURCES, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited)

(Amounts in thousands)

ALPHA METALLURGICAL RESOURCES, INC. AND SUBSIDIARIES

ADJUSTED EBITDA RECONCILIATION

(Amounts in thousands)

ALPHA METALLURGICAL RESOURCES, INC. AND SUBSIDIARIES

RESULTS OF OPERATIONS

(In thousands, except for per ton data)