Alpha Announces Third Quarter 2021 Results

• Reports net income from continuing operations of $83.7 million for the third quarter 2021

• Posts Adjusted EBITDA of $148.2 million for the third quarter 2021

• Nearly triples Met segment gross margin per ton quarter over quarter

• Increases Met realizations by 134% quarter over quarter on export tons tied to Australian indices

• Proactively reduces long-term debt and legacy obligations by over $75 million in third quarter, including early prepayments and repurchases

• Introduces guidance for 2022

BRISTOL, Tenn., November 5, 2021 – Alpha Metallurgical Resources, Inc. (NYSE: AMR), a leading U.S. supplier of metallurgical products for the steel industry, today reported results for the third quarter ending September 30, 2021.

(millions, except per share)

| Three months ended Sept. 30, 2021 | Three months ended June 30, 2021 | Three months ended Sept. 30, 2020 | |

|---|---|---|---|

| Net income (loss)(2) | $83.7 | $(18.6) | $(68.5) |

| Net income (loss)(2) per diluted share | $4.43 | $(1.01) | $(3.74) |

| Adjusted EBITDA(1) | $148.2 | $39.9 | $12.4 |

| Operating cash flow(3) | $96.0 | $(6.3) | $(5.9) |

| Capital expenditures(3) | $(22.3) | $(17.6) | $(27.8) |

| Tons of coal sold(2) | 4.7 | 4.0 | 4.0 |

__________________________________

1. These are non-GAAP financial measures. A reconciliation of Net Income to Adjusted EBITDA is included in tables accompanying the financial schedules.

2. From continuing operations.

3. Includes discontinued operations.

“We have consistently reiterated that Alpha is well-positioned to capitalize on market opportunities and this quarter’s outstanding performance is proof of our ability to deliver on those high expectations,” said David Stetson, Alpha’s chair and chief executive officer. “Additionally, we made meaningful progress on our commitment to deleveraging the company by reducing our overall long-term debt and legacy obligations by more than $75 million during the quarter. We expect to continue this positive momentum to create value for our shareholders, and we look forward to what we believe will be a productive and successful 2022.”

Financial Performance

Alpha reported net income from continuing operations of $83.7 million, or $4.43 per diluted share, for the third quarter 2021. In the second quarter 2021, the company had a net loss from continuing operations of $18.6 million or $1.01 per diluted share.

Total Adjusted EBITDA was $148.2 million for the third quarter, compared with $39.9 million in the second quarter 2021.

Coal Revenues

| (millions) | Three months ended Sept. 30, 2021 | Three months ended June 30, 2021 |

|---|---|---|

| Met Segment | $625.4 | $376.8 |

| All Other | $21.7 | $16.6 |

| Met Segment (excl. freight & handling)(1) | $497.2 | $312.5 |

| All Other (excl. freight & handling)(1) | $21.7 | $16.5 |

Tons Sold

| (millions) | Three months ended Sept. 30, 2021 | Three months ended June 30, 2021 |

|---|---|---|

| Met Segment | 4.4 | 3.7 |

| All Other | 0.3 | 0.3 |

__________________________________

1. Represents Non-GAAP coal revenues which is defined and reconciled under “Non-GAAP Financial Measures” and “Results of Operations.”

Coal Sales Realization(1)

| (per ton) | Three months ended Sept. 30, 2021 | Three months ended June 30, 2021 |

|---|---|---|

| Met Segment | $113.51 | $83.38 |

| All Other | $62.43 | $60.45 |

__________________________________

1. Represents Non-GAAP coal sales realization which is defined and reconciled under “Non-GAAP Financial Measures” and “Results of Operations.”

In the third quarter our net realized pricing for the Met segment was $113.51, while net realization in the All Other category was $62.43.

“As expected, third quarter met export realizations came in strong thanks to the robust market and the outstanding work of our sales team to capitalize on it,” said Andy Eidson, Alpha’s president and chief financial officer. “The vast midyear improvement in the Australian indices is now evident in our financial performance, with third quarter realizations on export tons tied to Aussie indices up $91.10, or 134%, from second quarter levels. Realizations for export tons priced against other mechanisms were up $23.64, or 23%, from second quarter realizations.”

The table below provides a breakdown of our Met segment coal sold in the third quarter by pricing mechanism.

(in millions, except per ton data)

Three months ended Sept. 30, 2021

| Met Segment Sales | Tons Sold | Coal Revenues | Realization/ton(1) | % of Met Tons Sold |

|---|---|---|---|---|

| Export - Other Pricing Mechanisms | 2.2 | $274.3 | $125.44 | 56% |

| Domestic | 1.0 | $89.2 | $86.05 | 27% |

| Export - Australian Indexed | 0.7 | $106.1 | $158.87 | 17% |

| Total Met Coal Revenues | 3.9 | $469.7 | $120.68 | 100% |

| Thermal Coal Revenues | 0.5 | $27.5 | $56.38 | |

| Total Met Segment Coal Revenues (excl. freight & handling)(1) | 4.4 | $497.2 | $113.51 |

__________________________________

1. Represents Non-GAAP coal sales realization which is defined and reconciled under “Non-GAAP Financial Measures” and “Results of Operations.”

Cost of Coal Sales

| (in millions, except per ton data) | Three months ended Sept. 30, 2021 | Three months ended June 30, 2021 |

|---|---|---|

| Cost of Coal Sales | $488.2 | $346.8 |

| Cost of Coal Sales (excl. freight & handling/idle)(1) | $352.1 | $273.8 |

| (per ton) | Three months ended Sept. 30, 2021 | Three months ended June 30, 2021 |

|---|---|---|

| Met Segment(1) | $76.62 | $69.94 |

| All Other(1) | $47.47 | $42.77 |

__________________________________

1. Represents Non-GAAP cost of coal sales and Non-GAAP cost of coal sales per ton which is defined and reconciled under “Non-GAAP Financial Measures” and “Results of Operations.”

“In higher pricing environments, costs of coal sales increase due to a number of factors outside our direct control, including royalties and taxes,” said Jason Whitehead, executive vice president and chief operating officer. “Similar to many other companies, we’re also experiencing some inflationary pressure with the cost of materials increasing. Despite these challenges, I’m proud of our operations teams for remaining disciplined and continuing to manage the costs we can control.”

In the third quarter, the company’s Met segment cost of coal sales increased to an average of $76.62 per ton as compared to $69.94 per ton in the prior quarter. Cost of coal sales for the All Other category increased to $47.47 in the third quarter from a second quarter average cost of $42.77 per ton.

Liquidity and Capital Resources

“Beyond Alpha’s very positive revenue results, we reduced our long-term debt and legacy obligations by over $75 million during the third quarter,” said Eidson. “In addition to $6.6 million in scheduled long-term principal payments for the quarter, we elected to make a voluntary prepayment of $31.0 million in principal on the term loan, and we repurchased, at a discount, roughly $18.7 million in outstanding principal borrowings from existing lenders. Coupled with the previously-announced $21.2 million payment in July to extinguish the reclamation funding obligations with the West Virginia Department of Environmental Protection (WVDEP), these actions should serve as a roadmap for what shareholders can expect from us in the coming quarters as we continue strengthening our balance sheet.”

“Subsequent to the quarter end, we made an early payment of $4 million to the WVDEP eliminate the legacy obligations related to water treatment in West Virginia. Additionally, we made a payment of $3.3 million to fully satisfy the remaining legacy reclamation funding and water treatment obligations owed to the State of Kentucky. This follows our early extinguishment of the West Virginia reclamation funding obligations that was announced last quarter. These examples further demonstrate our strong commitment to debt reduction and deleveraging the company,” Eidson said.

Cash provided by operating activities for the third quarter of 2021 was $96.0 million, which includes the receipt of the $70 million tax refund and related interest, compared to the prior period in which cash used in operating activities was $6.3 million. Cash provided by operating activities includes discontinued operations. Third quarter 2021 capital expenditures were $22.3 million compared to $17.6 million in capital expenditures in the second quarter.

As of September 30, 2021, Alpha had $78.3 million in unrestricted cash and $121.7 million in restricted cash, deposits and investments. Total long-term debt, including the current portion of long-term debt as of September 30, 2021, was $505.2 million. At the end of the third quarter, the company had total liquidity of $183.3 million, which represents an increase of 38% compared to our total liquidity at the end of the second quarter, including cash and cash equivalents of $78.3 million and $105.0 million of unused availability under the Asset-Based Revolving Credit Facility (ABL). The future available capacity under the ABL is subject to inventory and accounts receivable collateral requirements and the maintenance of certain financial ratios. As of September 30, 2021, the company had no borrowings and $120.0 million in letters of credit outstanding under the ABL.

Operational Update and Planned 2022 Investments

“Alpha’s exceptional third quarter performance is a testament to the continued dedication of our operations teams and the success of our ongoing portfolio optimization efforts,” said Whitehead. “With Slabcamp, our sole remaining thermal mine, on pace to close in the summer of next year, our 2022 production guidance reflects the final stage of our transition to a pure-play metallurgical resources company. As we look forward to capitalizing on current market opportunities, 2022 Met segment production is expected to increase slightly over the already-increased full year 2021 guidance level. I’m confident that our teams across the enterprise have the ability to deliver on these ambitious goals we’ve outlined for the coming year.”

During the quarter, a number of key structural milestones were met to add the fourth section at Road Fork 52, putting the project ahead of schedule and allowing the section to begin producing in mid-October. Additionally, the company has recently completed its budget for 2022, and our capital expenditures guidance for next year includes several important projects that will help modernize and strategically improve Alpha’s operations and prep plant infrastructure. These upgrades are expected to provide increased efficiency and extend the life of these facilities in return for modest levels of capital investment.

Whitehead commented on the importance of capex projects in 2022: “As we envision what Alpha can do in the next several years, we recognize the critical role that preparation plants play in washing and loading the coal we mine and preparing it for delivery to our customers. In partnership with our sales teams, we aim to maximize these facilities, and we believe modest investment in a few of our plants will allow for additional output and better capabilities for the specific coal qualities we’re sending through each facility. Additionally, we plan to begin development on the Cedar Grove No. 3 mine and the Glen Alum mine in the coming year. Both of these locations are adjacent to current Alpha operations in West Virginia, allowing us to leverage existing infrastructure as we expand into these mines. Lastly, we have decided to move ahead with adding a fourth section at our Lynn Branch mine. All together, we see this group of projects as a boost to the organization’s future efficiency and effectiveness. Furthermore, we believe we can accomplish each of these in a timely manner and at a very reasonable investment level. Therefore, at the midpoint, our capex guidance for next year includes an increased maintenance capital projection of approximately $120 million dollars to account for inflation, and roughly $55 million to invest in Alpha’s future through various projects across the organization.”

2021 Full-Year Guidance Adjustments

The company is increasing its 2021 cost of coal sales guidance in light of increased labor costs, inflationary pressure for certain supplies, such as steel used in roof support and diesel fuel, as well as higher royalties and taxes due to higher sales prices. Met segment cost of coal sales are now expected to be between $73.00 per ton and $77.00 per ton. Cost of coal sales for the All Other category is expected to remain in the existing range of $45.00 per ton and $49.00 per ton.

Additionally, with depreciation, depletion and amortization trending lower for the year, we are adjusting DD&A guidance down to a range of $100 million to $110 million from the prior range of $125 million to $145 million.

For 2021, Alpha has committed and priced approximately 96% of its metallurgical coal within the Met segment at an average price of $111.28 per ton and 98% of thermal coal in the Met segment at an average expected price of $55.76 per ton. In the All Other category the company is 90% committed and priced at an average price of $58.33 per ton.

Introducing 2022 Full-Year Guidance

The company is issuing 2022 operating guidance with coal shipments expected to be in the range of 15.4 million tons to 17.0 million tons. Met segment volume is expected to be between 14.8 million to 16.2 million tons. Within the Met segment, pure metallurgical coal shipments for the year are expected to be between 14.0 million to 15.0 million tons, and incidental thermal shipments in this segment are expected to be between 0.8 million to 1.2 million tons. Our guidance range of 0.6 million tons to 0.8 million tons for the All Other category represents production expectations from our last remaining thermal operation, the Slabcamp mine, which is on track to close in the summer of 2022.

For 2022, Alpha has committed and priced approximately 28% of its metallurgical coal within the Met segment at an average price of $195.43 per ton and 88% of thermal coal in the Met segment at an average expected price of $51.56 per ton. In the All Other category the company is 89% committed and priced at an average price of $56.49 per ton.

The company expects 2022 Met segment cost of coal sales per ton to be between $88.00 and $92.00, and costs for our All Other category are expected to be in the range of $58.00 to $62.00 per ton.

SG&A is expected to be in the range of $50 million to $54 million, excluding non-recurring expenses and non-cash stock compensation. Idle operations expense for 2022 is expected to be between $30 million and $40 million. The company expects cash interest expense to be in a range of $40 million to $45 million for 2022. Depreciation, depletion and amortization guidance is anticipated to be between $90 million and $110 million for the year. Our overall 2022 capital expenditures guidance of $160 million to $190 million includes a number of planned upgrades expected to enhance Alpha’s longevity and positioning for the future. Lastly, the company expects its tax rate for 2022 to be in the 5% to 15% range.

| 2021 Guidance | 2022 Guidance |

| in millions of tons | Low | High| Low | High |

|

|---|---|---|---|---|

| Metallurgical | 13.0 | 14.0 | 14.0 | 15.0 |

| Thermal | 1.3 | 1.8 | 0.8 | 1.2 |

| Met Segment | 14.3 | 15.8 | 14.8 | 16.2 |

| All Other | 1.3 | 1.7 | 0.6 | 0.8 |

| Total Shipments | 15.6 | 17.5 | 15.4 | 17.0 |

| Committed/Priced1,2,3 | Committed | Average Price | Committed | Average Price |

|---|---|---|---|---|

| Metallurgical - Domestic | $88.55 | $192.29 | ||

| Metallurgical - Export | $123.02 | $226.90 | ||

| Metallurgical Total | 96% | $111.28 | 28% | $195.43 |

| Thermal | 98% | $55.76 | 88% | $51.56 |

| Met Segment | 96% | $105.45 | 32% | $169.79 |

| All Other | 90% | $58.33 | 89% | $56.49 |

| Committed/Unpriced1,3 | Committed | Committed | ||

|---|---|---|---|---|

| Metallurgical Total | 4% | 23% | ||

| Thermal | --% | --% | ||

| Met Segment | 4% | 21% | ||

| All Other | 3% | --% |

| Costs per ton4 | Low | High | Low | High |

|---|---|---|---|---|

| Met Segment | $73.00 | $77.00 | $88.00 | $92.00 |

| All Other | $45.00 | $49.00 | $58.00 | $62.00 |

| In millions (except taxes) | Low | High | Low | High |

|---|---|---|---|---|

| SG&A5 | $48 | $52 | $50 | $54 |

| Idle Operations Expense | $24 | $30 | $30 | $40 |

| Cash Interest Expense | $51 | $55 | $40 | $45 |

| DD&A | $100 | $110 | $90 | $110 |

| Capital Expenditures | $88 | $98 | $160 | $190 |

| Tax Rate6 | --% | 5% | 5% | 15% |

Notes:

1. Based on committed and priced coal shipments as of October 29, 2021. Committed percentage based on the midpoint of shipment guidance range.

2. Actual average per-ton realizations on committed and priced tons recognized in future periods may vary based on actual freight expense in future periods relative to assumed freight expense embedded in projected average per-ton realizations.

3. Includes estimates of future coal shipments based upon contract terms and anticipated delivery schedules. Actual coal shipments may vary from these estimates.

4. Note: The Company is unable to present a quantitative reconciliation of its forward-looking non-GAAP cost of coal sales per ton sold financial measures to the most directly comparable GAAP measures without unreasonable efforts due to the inherent difficulty in forecasting and quantifying with reasonable accuracy significant items required for the reconciliation. The most directly comparable GAAP measure, GAAP cost of sales, is not accessible without unreasonable efforts on a forward-looking basis. The reconciling items include freight and handling costs, which are a component of GAAP cost of sales. Management is unable to predict without unreasonable efforts freight and handling costs due to uncertainty as to the end market and FOB point for uncommitted sales volumes and the final shipping point for export shipments. These amounts have historically varied and may continue to vary significantly from quarter to quarter and material changes to these items could have a significant effect on our future GAAP results.

5. Excludes expenses related to non-cash stock compensation and non-recurring expenses.

6. Rate assumes no further ownership change limitations on the usage of net operating losses.

Conference Call

The company plans to hold a conference call regarding its third quarter 2021 results on November 5, 2021, at 10:00 a.m. Eastern time. The conference call will be available live on the investor section of the company’s website at https://investors.alphametresources.com/investors. Analysts who would like to participate in the conference call should dial 844-200-6205 (domestic toll-free) or 929-526-1599 (international) approximately 15 minutes prior to start time. Please use the access code 475225 to join the call.

About Alpha Metallurgical Resources

Alpha Metallurgical Resources (NYSE: AMR) is a Tennessee-based mining company with operations across Virginia and West Virginia. With customers across the globe, high-quality reserves and significant port capacity, Alpha reliably supplies metallurgical products to the steel industry. For more information, visit www.AlphaMetResources.com.

Forward-Looking Statements

This news release includes forward-looking statements. These forward-looking statements are based on Alpha’s expectations and beliefs concerning future events and involve risks and uncertainties that may cause actual results to differ materially from current expectations. These factors are difficult to predict accurately and may be beyond Alpha’s control. Forward-looking statements in this news release or elsewhere speak only as of the date made. New uncertainties and risks arise from time to time, and it is impossible for Alpha to predict these events or how they may affect Alpha. Except as required by law, Alpha has no duty to, and does not intend to, update or revise the forward-looking statements in this news release or elsewhere after the date this release is issued. In light of these risks and uncertainties, investors should keep in mind that results, events or developments discussed in any forward-looking statement made in this news release may not occur.

FINANCIAL TABLES FOLLOW

Non-GAAP Financial Measures

The discussion below contains “non-GAAP financial measures.” These are financial measures which either exclude or include amounts that are not excluded or included in the most directly comparable measures calculated and presented in accordance with generally accepted accounting principles in the United States (“U.S. GAAP” or “GAAP”). Specifically, we make use of the non-GAAP financial measures “Adjusted EBITDA,” “non-GAAP coal revenues,” “non-GAAP cost of coal sales,” “non-GAAP coal margin,” and “Adjusted cost of produced coal sold.” We use Adjusted EBITDA to measure the operating performance of our segments and allocate resources to the segments. Adjusted EBITDA does not purport to be an alternative to net income (loss) as a measure of operating performance or any other measure of operating results or liquidity presented in accordance with GAAP. We use non-GAAP coal revenues to present coal revenues generated, excluding freight and handling fulfillment revenues. Non-GAAP coal sales realization per ton for our operations is calculated as non-GAAP coal revenues divided by tons sold. We use non-GAAP cost of coal sales to adjust cost of coal sales to remove freight and handling costs, depreciation, depletion and amortization – production (excluding the depreciation, depletion and amortization related to selling, general and administrative functions), accretion on asset retirement obligations, amortization of acquired intangibles, net, and idled and closed mine costs. Non-GAAP cost of coal sales per ton for our operations is calculated as non-GAAP cost of coal sales divided by tons sold. Non-GAAP coal margin per ton for our coal operations is calculated as non-GAAP coal sales realization per ton for our coal operations less non-GAAP cost of coal sales per ton for our coal operations. We also use Adjusted cost of produced coal sold to distinguish the cost of captive produced coal from the effects of purchased coal. The presentation of these measures should not be considered in isolation, or as a substitute for analysis of our results as reported under GAAP.

Management uses non-GAAP financial measures to supplement GAAP results to provide a more complete understanding of the factors and trends affecting the business than GAAP results alone. The definition of these non-GAAP measures may be changed periodically by management to adjust for significant items important to an understanding of operating trends and to adjust for items that may not reflect the trend of future results by excluding transactions that are not indicative of our core operating performance. Furthermore, analogous measures are used by industry analysts to evaluate the Company’s operating performance. Because not all companies use identical calculations, the presentations of these measures may not be comparable to other similarly titled measures of other companies and can differ significantly from company to company depending on long-term strategic decisions regarding capital structure, the tax jurisdictions in which companies operate, and capital investments.

Included below are reconciliations of non-GAAP financial measures to GAAP financial measures.

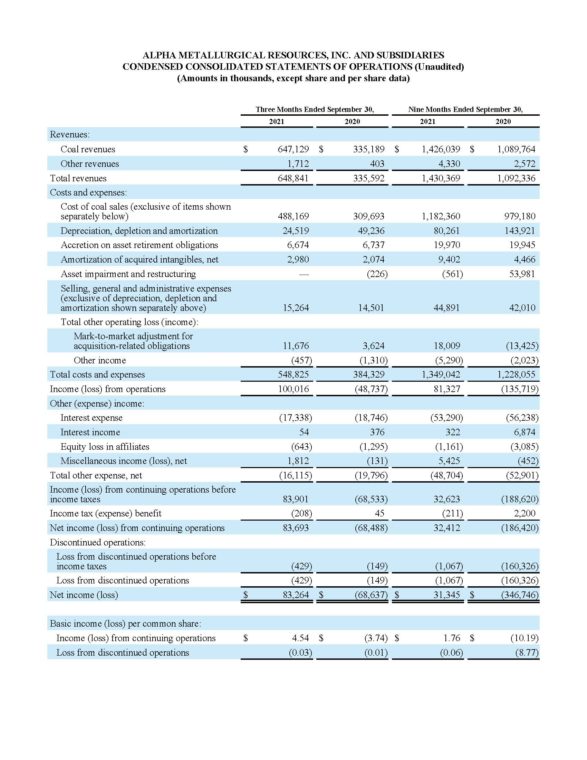

ALPHA METALLURGICAL RESOURCES, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited)

(Amounts in thousands, except share and per share data)

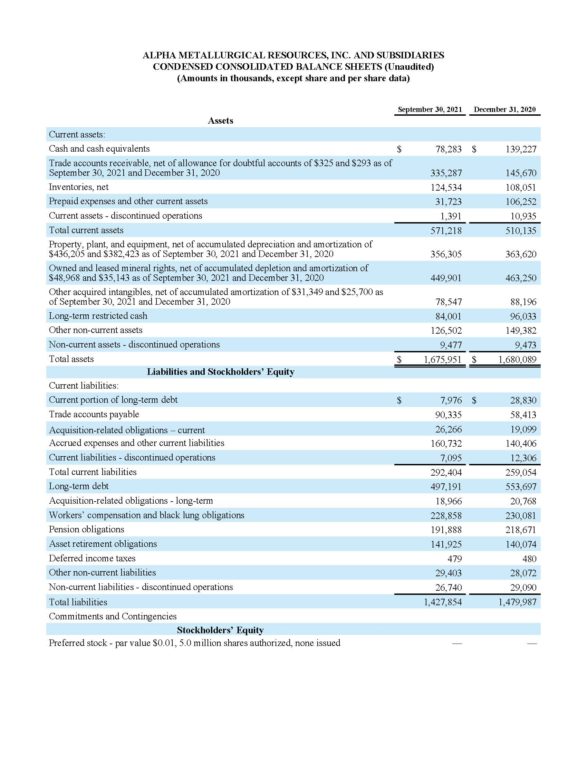

ALPHA METALLURGICAL RESOURCES, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS (Unaudited)

(Amounts in thousands, except share and per share data)

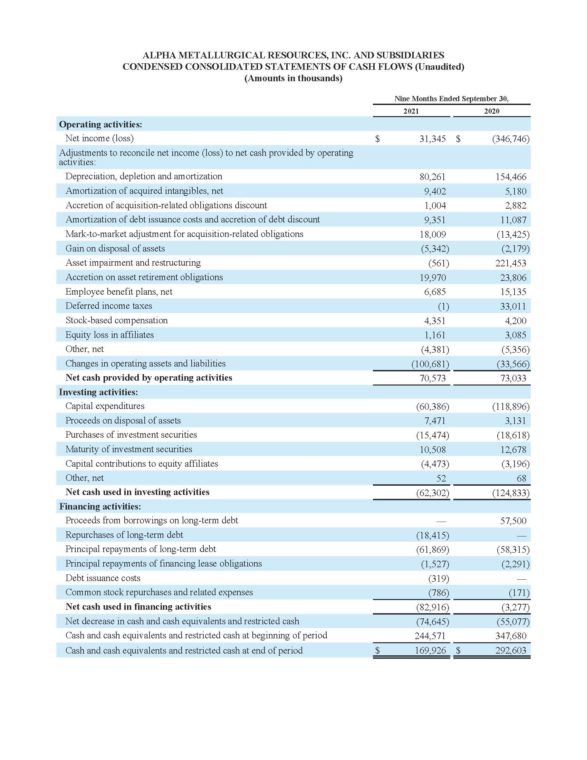

ALPHA METALLURGICAL RESOURCES, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited)

(Amounts in thousands)

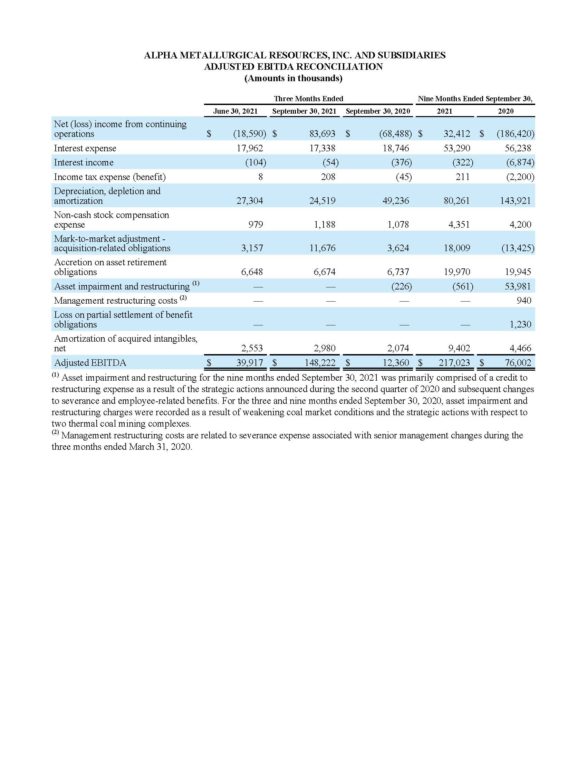

ALPHA METALLURGICAL RESOURCES, INC. AND SUBSIDIARIES

ADJUSTED EBITDA RECONCILIATION

(Amounts in thousands)

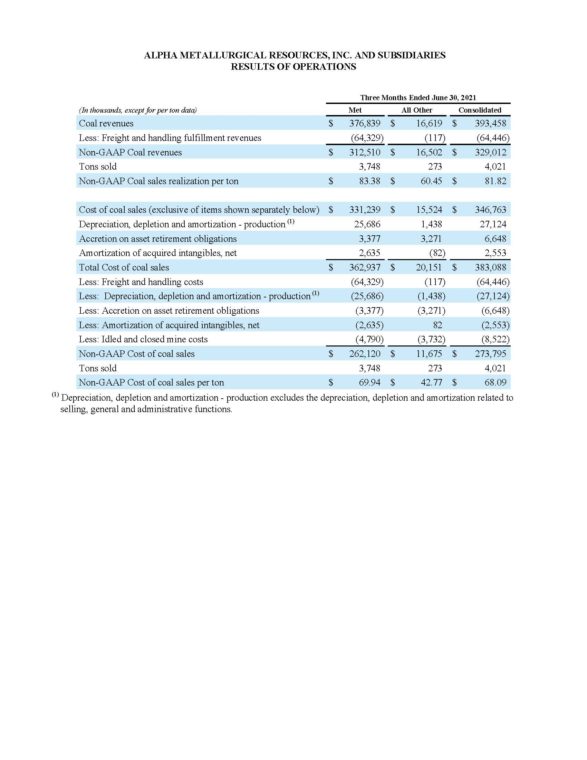

ALPHA METALLURGICAL RESOURCES, INC. AND SUBSIDIARIES

RESULTS OF OPERATIONS

(In thousands, except for per ton data)