Alpha Announces Fourth Quarter and Full Year 2021 Results

• Reports record net income from continuing operations of $254.5 million for the fourth quarter 2021

• Posts record Adjusted EBITDA of $315.8 million for the fourth quarter 2021

• Further reduces long-term debt with early principal payments of $50 million on the term loan within the quarter

• Announces $150 million share repurchase program

• Completes refinancing of Asset-Based Revolving Credit Facility (ABL)

BRISTOL, Tenn., March 7, 2022 – Alpha Metallurgical Resources, Inc. (NYSE: AMR), a leading U.S. supplier of metallurgical products for the steel industry, today reported results for the fourth quarter and full year ending December 31, 2021.

(millions, except per share)

| Three months ended Dec. 31, 2021 | Three months ended Sept. 30, 2021 | Three months ended Dec. 31, 2020 | |

|---|---|---|---|

| Net income (loss)(2) | $254.5 | $83.7 | ($55.1) |

| Net income (loss)(2) per diluted share | $13.30 | $4.43 | ($3.00) |

| Adjusted EBITDA(1) | $315.8 | $148.2 | $7.4 |

| Operating cash flow(3) | $104.3 | $96.0 | $56.2 |

| Capital expenditures(3) | ($22.9) | ($22.3) | $35.1 |

| Tons of coal sold(2) | 4.0 | 4.7 | 3.7 |

__________________________________

1. These are non-GAAP financial measures. A reconciliation of Net Income to Adjusted EBITDA is included in tables accompanying the financial schedules.

2. From continuing operations.

3. Includes discontinued operations.

“Thanks to the continued dedication of our team, Alpha closed out the fourth quarter with an impressive $315.8 million in EBITDA and continued significant reduction in our long-term debt level,” said David Stetson, Alpha’s chair and chief executive officer. “In looking back on 2021, it was truly a transformational time for the company, complete with a name change to Alpha Metallurgical Resources at the start of the year and a series of important steps in solidifying our role as a leading pure-play metallurgical coal company and building on our role as the largest U.S. met coal producer. We transitioned our portfolio towards lower-cost and higher-quality operations, refreshed our board of directors, and completed refinancing of our ABL. Importantly, we are also making swift work of our balance sheet transformation. In a few short months we dramatically reduced the company’s long-term debt and legacy liabilities, further strengthening the already firm foundation that Alpha enjoys. We have continued this momentum with an excellent start in 2022 and, if coal markets remain robust, we expect to be in a position to eliminate our long-term debt within the calendar year. Given our cash generation projections for the year, I’m pleased to announce that our board has approved a $150 million share repurchase program to continue increasing shareholder value.”

Additionally, the board of directors has scheduled the company’s annual meeting of stockholders for May 3, 2022.

Financial Performance

Alpha reported net income from continuing operations of $254.5 million, or $13.30 per diluted share, for the fourth quarter 2021. In the third quarter 2021, the company had net income from continuing operations of $83.7 million or $4.43 per diluted share.

Total Adjusted EBITDA was $315.8 million for the fourth quarter, compared with $148.2 million in the third quarter 2021.

Coal Revenues

| (millions) | Three months ended Dec. 31, 2021 | Three months ended Sept. 30, 2021 |

|---|---|---|

| Met Segment | $811.5 | $625.4 |

| All Other | $15.0 | $21.7 |

| Met Segment (excl. freight & handling)(1) | $683.6 | $497.2 |

| All Other (excl. freight & handling)(1) | $15.0 | $21.7 |

Tons Sold

| (millions) | Three months ended Dec. 31, 2021 | Three months ended Sept. 30, 2021 |

|---|---|---|

| Met Segment | 3.8 | 4.4 |

| All Other | 0.2 | 0.3 |

__________________________________

1. Represents Non-GAAP coal revenues which is defined and reconciled under “Non-GAAP Financial Measures” and “Results of Operations.”

Coal Sales Realization(1)

| (per ton) | Three months ended Dec. 31, 2021 | Three months ended Sept. 30, 2021 |

|---|---|---|

| Met Segment | $180.66 | $113.51 |

| All Other | $62.56 | $62.43 |

__________________________________

1. Represents Non-GAAP coal sales realization which is defined and reconciled under “Non-GAAP Financial Measures” and “Results of Operations.”

In the fourth quarter our net realized pricing for the Met segment was $180.66 per ton, while net realization in the All Other category was $62.56.

“Realizations for the fourth quarter continued to trend upward as expected, with our export business highlighting the benefit of the elevated global pricing dynamics in the metallurgical market,” said Andy Eidson, Alpha’s president and chief financial officer. “We look forward to future quarters when our 2022 domestic realizations are expected to improve significantly as a result of the negotiations completed by our sales team late last year. Even with lower domestic pricing that had been locked in long ago, our realizations on met coal for the quarter still came in at an average of $197 per ton.”

The table below provides a breakdown of our Met segment coal sold in the fourth quarter by pricing mechanism.

(in millions, except per ton data)

Three months ended Dec. 31, 2021

| Met Segment Sales | Tons Sold | Coal Revenues | Realization/ton(1) | % of Met Tons Sold |

|---|---|---|---|---|

| Export - Other Pricing Mechanisms | 1.4 | $349.1 | $251.12 | 42% |

| Domestic | 1.1 | $95.7 | $90.87 | 31% |

| Export - Australian Indexed | 0.9 | $213.5 | $239.08 | 27% |

| Total Met Coal Revenues | 3.3 | $658.2 | $197.31 | 100% |

| Thermal Coal Revenues | 0.4 | $25.4 | $56.62 | |

| Total Met Segment Coal Revenues (excl. freight & handling)(1) | 3.7 | $683.6 | $180.66 |

__________________________________

1. Represents Non-GAAP coal sales realization which is defined and reconciled under “Non-GAAP Financial Measures” and “Results of Operations.”

Cost of Coal Sales

| (in millions, except per ton data) | Three months ended Dec. 31, 2021 | Three months ended Sept. 30, 2021 |

|---|---|---|

| Cost of Coal Sales | $497.4 | $488.2 |

| Cost of Coal Sales (excl. freight & handling/idle)(1) | $364.4 | $352.1 |

| (per ton) | Three months ended Dec. 31, 2021 | Three months ended Sept. 30, 2021 |

|---|---|---|

| Met Segment(1) | $92.46 | $76.62 |

| All Other(1) | $60.77 | $47.47 |

__________________________________

1. Represents Non-GAAP cost of coal sales and Non-GAAP cost of coal sales per ton which is defined and reconciled under “Non-GAAP Financial Measures” and “Results of Operations.”

“As pricing for our products remains higher, we encounter elevated costs of coal sales levels as a result, especially for factors such as royalties and taxes which are tied directly to sales price,” said Jason Whitehead, executive vice president and chief operating officer. “We’ve discussed this in prior quarters, but my focus for the operations teams is to continue positively influencing the factors directly within our control, such as safety and productivity. These are the foundational elements that allow us to effectively manage our costs. On the whole, our teams have done a good job in this regard.”

In the fourth quarter, the company’s Met segment cost of coal sales increased to an average of $92.46 per ton as compared to $76.62 per ton in the prior quarter. Cost of coal sales for the All Other category increased to $60.77 per ton in the fourth quarter from an average cost of $47.47 per ton in the third quarter.

Liquidity and Capital Resources

“As we’ve reiterated consistently over the last several quarters, our focus continues to be debt reduction and creating a fortress balance sheet,” said Eidson. “In the fourth quarter, we made another $50.0 million in voluntary principal prepayments on the term loan. To put that in perspective, in the second half of 2021, we paid an aggregate of $101.1 million in principal, coupled with the previously announced payments to satisfy certain legacy liabilities. Since then, we’ve made another $150.0 million in principal prepayments on the term loan, bringing our current debt level to under $300 million. Assuming market conditions remain at levels similar to the last few months, we will be able to achieve our goal of aggressively paying off our debt in short order, while also maintaining an appropriate level of liquidity. In addition, we have enough visibility into near term cash flows to support the share repurchase program we have announced today.”

Cash provided by operating activities increased for the fourth quarter of 2021 to $104.3 million as compared to third quarter’s $96.0 million. Cash provided by operating activities includes discontinued operations. Capital expenditures for the fourth quarter were $22.9 million compared to $22.3 million for the third quarter of 2021.

In December 2021, Alpha announced the successful completion of its ABL refinancing.

As of December 31, 2021, Alpha had $81.2 million in unrestricted cash and $131.2 million in restricted cash, deposits and investments. Total long-term debt, including the current portion of long-term debt as of December 31, 2021, was $448.6 million. At the end of the fourth quarter, the company had total liquidity of $115.2 million, including cash and cash equivalents of $81.2 million and $34.0 million of unused availability under the ABL. The future available capacity under the ABL is subject to inventory and accounts receivable collateral requirements and the maintenance of certain financial ratios. As of December 31, 2021, the company had no borrowings and $121.0 million in letters of credit outstanding under the ABL.

Operational and Performance Update

As further optimization of our portfolio, the company closed a transaction on November 5, 2021 to divest the idled Delbarton mining complex and associated assets, which include Delbarton preparation plant and Kielty mine. Additionally, on December 31, 2021, the idled Edwight surface mine and certain associated assets were divested. Together, these divestitures resulted in a reduction in reclamation obligations of $18.0 million.

Subsequent to the fourth quarter close on February 10, 2022, the fourth section of Lynn Branch began operation, completing one of the 2022 strategic uses of capital. We continue to make progress on the other projects in Alpha’s previously disclosed growth capex plan for 2022.

As of February 25, 2022, Alpha has committed and priced approximately 39% of its metallurgical coal within the Met segment at an average price of $204.75 per ton and 100% of thermal coal in the Met segment at an average expected price of $52.46 per ton. In the All Other category the company is 82% committed and priced at an average price of $57.24 per ton.

2022 Guidance

| in millions of tons | Low | High |

|---|---|---|

| Metallurgical | 14.0 | 15.0 |

| Thermal | 0.8 | 1.2 |

| Met Segment | 14.8 | 16.2 |

| All Other | 0.6 | 0.8 |

| Total Shipments | 15.4 | 17.0 |

| Committed/Priced1,2,3 | Committed | Average Price |

|---|---|---|

| Metallurgical - Domestic | $189.31 | |

| Metallurgical - Export | $236.99 | |

| Metallurgical Total | 39% | $204.75 |

| Thermal | 100% | $52.46 |

| Met Segment | 44% | $180.36 |

| All Other | 82% | $57.24 |

| Committed/Unpriced1,3 | Committed | |

|---|---|---|

| Metallurgical Total | 39% | |

| Thermal | --% | |

| Met Segment | 37% | |

| All Other | --% |

| Costs per ton4 | Low | High |

|---|---|---|

| Met Segment | $88.00 | $92.00 |

| All Other | $58.00 | $62.00 |

| In millions (except taxes) | Low | High |

|---|---|---|

| SG&A5 | $50 | $54 |

| Idle Operations Expense | $30 | $40 |

| Cash Interest Expense | $40 | $45 |

| DD&A | $90 | $110 |

| Capital Expenditures | $160 | $190 |

| Tax Rate6 | 5% | 15% |

Notes:

1. Based on committed and priced coal shipments as of February 25, 2022. Committed percentage based on the midpoint of shipment guidance range.

2. Actual average per-ton realizations on committed and priced tons recognized in future periods may vary based on actual freight expense in future periods relative to assumed freight expense embedded in projected average per-ton realizations.

3. Includes estimates of future coal shipments based upon contract terms and anticipated delivery schedules. Actual coal shipments may vary from these estimates.

4. Note: The Company is unable to present a quantitative reconciliation of its forward-looking non-GAAP cost of coal sales per ton sold financial measures to the most directly comparable GAAP measures without unreasonable efforts due to the inherent difficulty in forecasting and quantifying with reasonable accuracy significant items required for the reconciliation. The most directly comparable GAAP measure, GAAP cost of sales, is not accessible without unreasonable efforts on a forward-looking basis. The reconciling items include freight and handling costs, which are a component of GAAP cost of sales. Management is unable to predict without unreasonable efforts freight and handling costs due to uncertainty as to the end market and FOB point for uncommitted sales volumes and the final shipping point for export shipments. These amounts have historically varied and may continue to vary significantly from quarter to quarter and material changes to these items could have a significant effect on our future GAAP results.

5. Excludes expenses related to non-cash stock compensation and non-recurring expenses.

6. Rate assumes no further ownership change limitations on the usage of net operating losses.

Share Repurchase Program

Alpha also announced today that its board of directors authorized a share repurchase program allowing for the expenditure of up to $150 million for the repurchase of the company’s common stock. Repurchases will be made from time to time in accordance with applicable securities laws in the open market, and may include repurchases pursuant to Rule 10b5-1 trading plans. The share repurchase program is effective immediately and repurchases may begin as soon as March 9, 2022.

The repurchase program does not obligate the company to acquire any particular amount of common stock or to acquire shares on any particular timetable, and the program may be suspended at any time at the company’s discretion. The timing and amount of share repurchases will be determined by the company’s management based on its evaluation of market conditions, the trading price of the stock, applicable legal requirements, compliance with the provisions of the company’s debt agreements, and other factors.

Conference Call

The company plans to hold a conference call regarding its fourth quarter and full year 2021 results on March 7, 2022, at 10:00 a.m. Eastern time. The conference call will be available live on the investor section of the company’s website at https://investors.alphametresources.com/investors. Analysts who would like to participate in the conference call should dial 844-200-6205 (domestic toll-free) or 929-526-1599 (international) approximately 15 minutes prior to start time. Please use the access code 475225 to join the call.

About Alpha Metallurgical Resources

Alpha Metallurgical Resources (NYSE: AMR) is a Tennessee-based mining company with operations across Virginia and West Virginia. With customers across the globe, high-quality reserves and significant port capacity, Alpha reliably supplies metallurgical products to the steel industry. For more information, visit www.AlphaMetResources.com.

Forward-Looking Statements

This news release includes forward-looking statements. These forward-looking statements are based on Alpha’s expectations and beliefs concerning future events and involve risks and uncertainties that may cause actual results to differ materially from current expectations. These factors are difficult to predict accurately and may be beyond Alpha’s control. Forward-looking statements in this news release or elsewhere speak only as of the date made. New uncertainties and risks arise from time to time, and it is impossible for Alpha to predict these events or how they may affect Alpha. Except as required by law, Alpha has no duty to, and does not intend to, update or revise the forward-looking statements in this news release or elsewhere after the date this release is issued. In light of these risks and uncertainties, investors should keep in mind that results, events or developments discussed in any forward-looking statement made in this news release may not occur.

FINANCIAL TABLES FOLLOW

Non-GAAP Financial Measures

The discussion below contains “non-GAAP financial measures.” These are financial measures which either exclude or include amounts that are not excluded or included in the most directly comparable measures calculated and presented in accordance with generally accepted accounting principles in the United States (“U.S. GAAP” or “GAAP”). Specifically, we make use of the non-GAAP financial measures “Adjusted EBITDA,” “non-GAAP coal revenues,” “non-GAAP cost of coal sales,” “non-GAAP coal margin,” and “Adjusted cost of produced coal sold.” We use Adjusted EBITDA to measure the operating performance of our segments and allocate resources to the segments. Adjusted EBITDA does not purport to be an alternative to net income (loss) as a measure of operating performance or any other measure of operating results or liquidity presented in accordance with GAAP. We use non-GAAP coal revenues to present coal revenues generated, excluding freight and handling fulfillment revenues. Non-GAAP coal sales realization per ton for our operations is calculated as non-GAAP coal revenues divided by tons sold. We use non-GAAP cost of coal sales to adjust cost of coal sales to remove freight and handling costs, depreciation, depletion and amortization – production (excluding the depreciation, depletion and amortization related to selling, general and administrative functions), accretion on asset retirement obligations, amortization of acquired intangibles, net, and idled and closed mine costs. Non-GAAP cost of coal sales per ton for our operations is calculated as non-GAAP cost of coal sales divided by tons sold. Non-GAAP coal margin per ton for our coal operations is calculated as non-GAAP coal sales realization per ton for our coal operations less non-GAAP cost of coal sales per ton for our coal operations. We also use Adjusted cost of produced coal sold to distinguish the cost of captive produced coal from the effects of purchased coal. The presentation of these measures should not be considered in isolation, or as a substitute for analysis of our results as reported under GAAP.

Management uses non-GAAP financial measures to supplement GAAP results to provide a more complete understanding of the factors and trends affecting the business than GAAP results alone. The definition of these non-GAAP measures may be changed periodically by management to adjust for significant items important to an understanding of operating trends and to adjust for items that may not reflect the trend of future results by excluding transactions that are not indicative of our core operating performance. Furthermore, analogous measures are used by industry analysts to evaluate the Company’s operating performance. Because not all companies use identical calculations, the presentations of these measures may not be comparable to other similarly titled measures of other companies and can differ significantly from company to company depending on long-term strategic decisions regarding capital structure, the tax jurisdictions in which companies operate, and capital investments.

Included below are reconciliations of non-GAAP financial measures to GAAP financial measures.

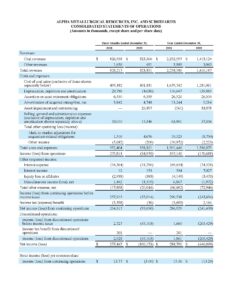

ALPHA METALLURGICAL RESOURCES, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(Amounts in thousands, except share and per share data)

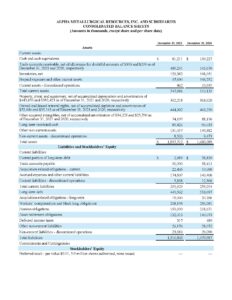

ALPHA METALLURGICAL RESOURCES, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(Amounts in thousands, except share and per share data)

ALPHA METALLURGICAL RESOURCES, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Amounts in thousands)

ALPHA METALLURGICAL RESOURCES, INC. AND SUBSIDIARIES

ADJUSTED EBITDA RECONCILIATION

(Amounts in thousands)

ALPHA METALLURGICAL RESOURCES, INC. AND SUBSIDIARIES

RESULTS OF OPERATIONS

(In thousands, except for per ton data)